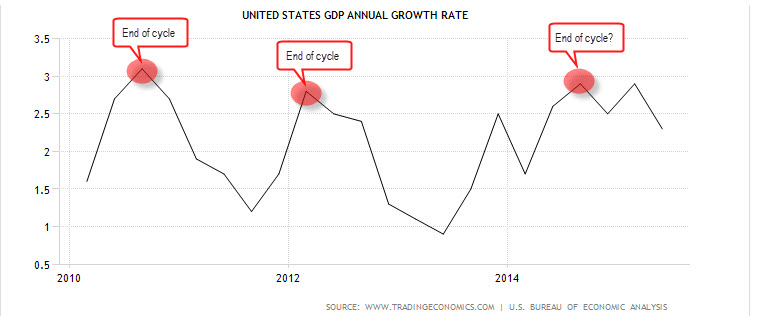

Hello traders and MarketClub members everywhere! Here we are at the end of the week, the end of the month and anticipating a full moon this weekend. It has been quite a week and quite a month and I will be covering that in today's video.

One of my trading rituals that I do every week is look at how the markets have performed for the week. I don't mean that I look at every up and down movement, but I want to see if the market closed on a positive or negative note. I also do this on a monthly basis, at the end of every month or the last day of trading for the month, to see how a market has performed during the month. Much like my weekly ritual, I want to see if the markets I am following gained points or lost ground for the month.

I find this sort of exercise very refreshing as it takes out a lot of the clutter that surrounds the markets during the day. When you expand that exercise to a monthly time frame, you get to see a much clearer view of where a market is heading. Continue reading "A Valued Trading Ritual"