It is always interesting to live through history. However, I think many traders, or should say investors would probably like to forget about the history making market action on Thursday.

It is always interesting to live through history. However, I think many traders, or should say investors would probably like to forget about the history making market action on Thursday.

I just wanted to write a short post and show you where we stand with our "Trade Triangle" technology.

One of the advantages of using MarketClub's "Trade Triangles" is that you don't have to worry about the problems in Greece, nor do you have to worry about earnings reports, downgrades, supply and demand statistics, and all of the millions of other things that make up the price of a stock or a commodity.

An inescapable reality of the market, that effects all of us, is perception. This one characteristic can trump earnings reports, good news, and any other market changing force that comes out. For the last 12 months, the perception has been that things are getting better, and that pushed the market higher. Perception may have changed yesterday as investors are now once again beginning to worry about the euro, sovereign debt, and the value of paper currencies.

So here is how we stand in the major markets with our "Trade Triangle" technology: Continue reading "After yesterday, you need this to survive the future"

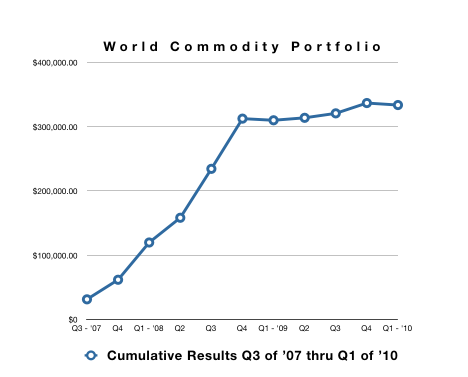

We began Q1 with high hopes of keeping our winning streak alive, just as we had finished out the year on a very positive note with some strong gains in Q4 of 2009.

We began Q1 with high hopes of keeping our winning streak alive, just as we had finished out the year on a very positive note with some strong gains in Q4 of 2009.