This is a traditional post with a performance review of top currencies versus gold at the end of the year.

The fiat money is represented by 7 currencies: US Dollar (USD) and 6 components of the US Dollar Index (DXY) placed by weight: Euro (EUR), Japanese yen (JPY), British Pound (GBP), Canadian Dollar (CAD), Swedish Krona (SEK) and the Swiss Franc (CHF).

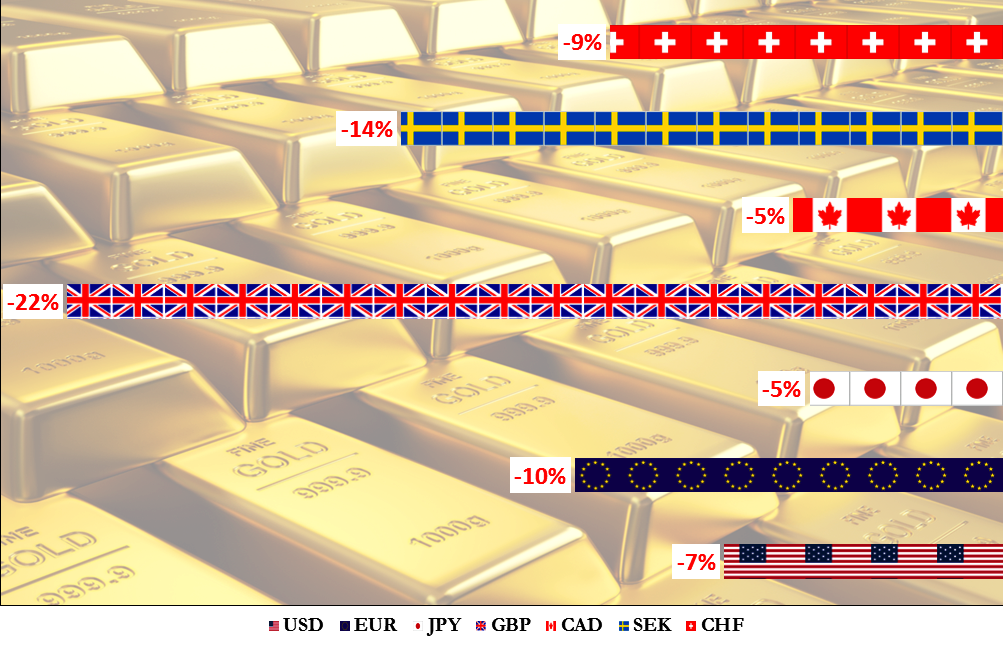

Chart 1. Year-To-Date Dynamics Of Top 7 Currencies Versus Gold: The Only Winner

Diagram by Aibek Burabayev; Source: tradingview.com

This year the gold was almost as strong as last year compared to the top currencies and only one rival could escape from its death grip. The Euro was also very strong this year as the Euro Index scored a hefty 7.26% gain against its peers (USD, GBP, JPY, CHF). It helped the euro to outweigh gold by 2%. Last year the EUR finished on 5th place.

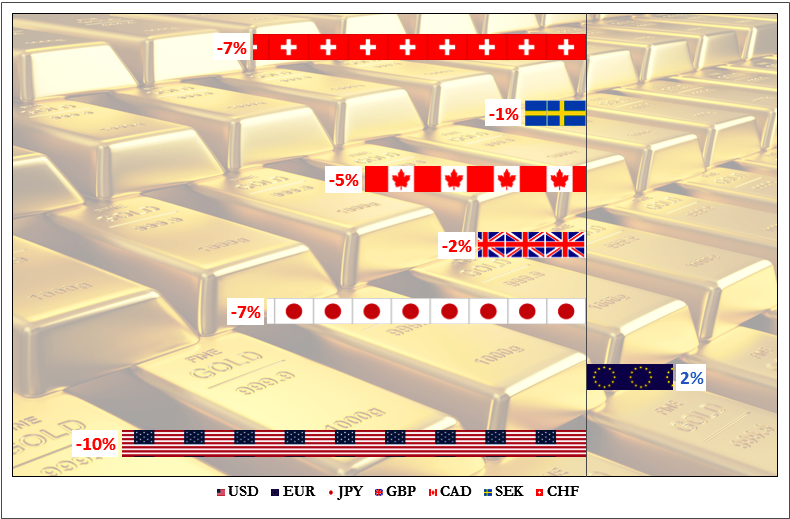

Below is the full ranking for Y2017 with the Y2016 places in the brackets. Continue reading "Top Currencies Vs. Gold: Which Fiat Could Beat Gold in 2017?"