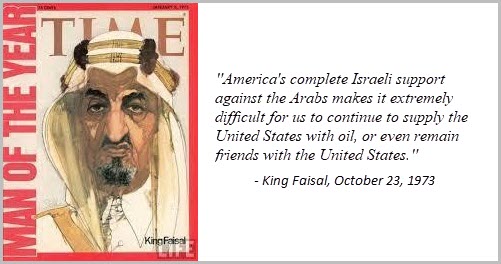

On October 20, 1973, Saudi King Faisal announced KSA was joining in an oil embargo against the United States and Europe in favor of the Arab position in the Yom Kippur War. In an interview with international media, King Faisal said:

“America's complete Israeli support against the Arabs makes it extremely difficult for us to continue to supply the United States with oil, or even remain friends with the United States."

The price of oil quadrupled in short order, a few months. The oil shortage in America was managed by gasoline rationing by President Nixon. Drivers could buy gasoline on “odd” or “even” days, depending on the last digit of their license plate. There was also a maximum dollar amount set on purchases of $10. Motorists often had to wait in line for an hour to buy gas.

The economic impact on the U.S. and the world economy was devasting. It caused a massive recession in 1974-75, even though the embargo was lifted in March 1974. The Saudis and other OPEC producers learned how “inelastic” (i.e., non-responsive to price) gasoline demand was and their ability to stuff their coffers even with small cuts to production. Continue reading "Saudi Arabia's "Mini Oil Embargo" May Backfire"