Dear readers, thank you for sharing a moment to leave your stocks preferences below my previous post! Some of you even trusted me to analyze some high-tech stocks, I am honored, and maybe one day I will find time to do it. Silver stocks and gold stocks are in your focus as I understood. This post is dedicated to the silver stocks.

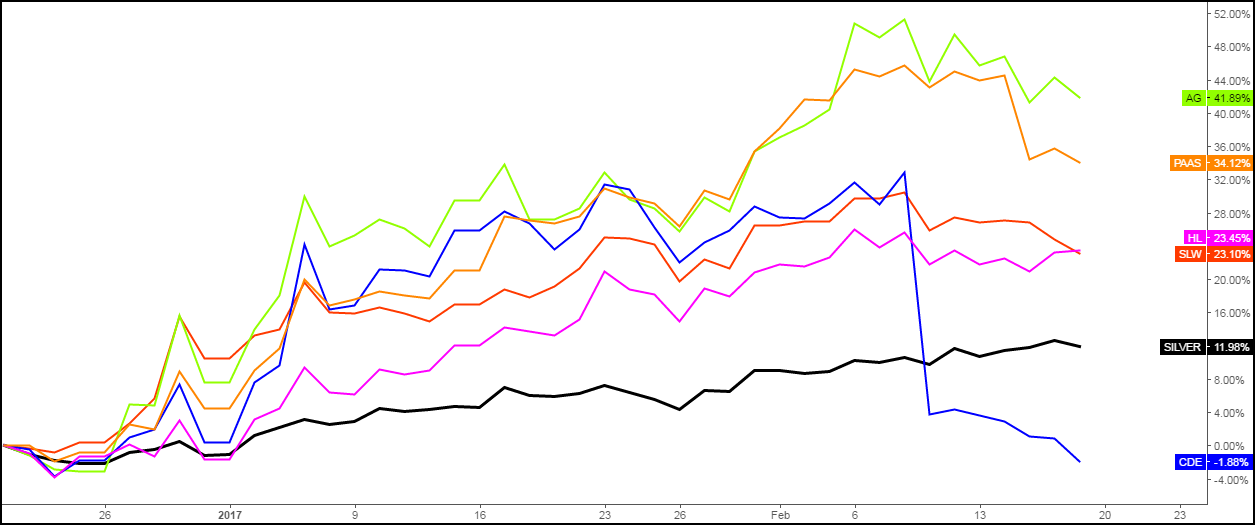

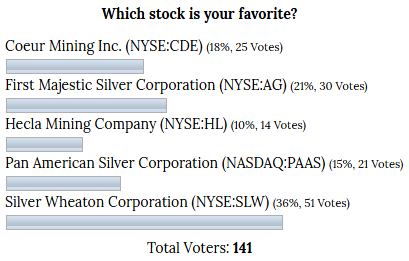

This February I analyzed the top silver stocks (by market cap) and brought you some interesting and potentially profitable disparity that I found on the chart. After the comparison chart I asked you to pick your favorite stock among the top five and below is the graph of the voting results.

Graph 1. February 2017 Stock Pick Voting Results

The majority of you chose Silver Wheaton Corp. (NYSE:SLW) as your favorite. First Majestic Silver Corporation (NYSE:AG) ranked second and Coeur Mining Inc. (NYSE:CDE) was the third. Let’s see how those stocks behaved after the vote in the chart below that covers the period from the vote till now. Continue reading "Silver Stocks: Favorite Failed To Deliver... Or Not?"