Deploying skill and caution when engaging in options trading can generate consistent monthly income while defining risk, leveraging a minimal amount of capital, and maximizing return on investment. Options can augment portfolio appreciation across an array of different market scenarios. Over the past 13 months (May 2020 – May 2021) and 275 trades, a win rate of 98% was achieved with an average ROI per winning trade of 8.0% and an overall option premium capture of 85%.

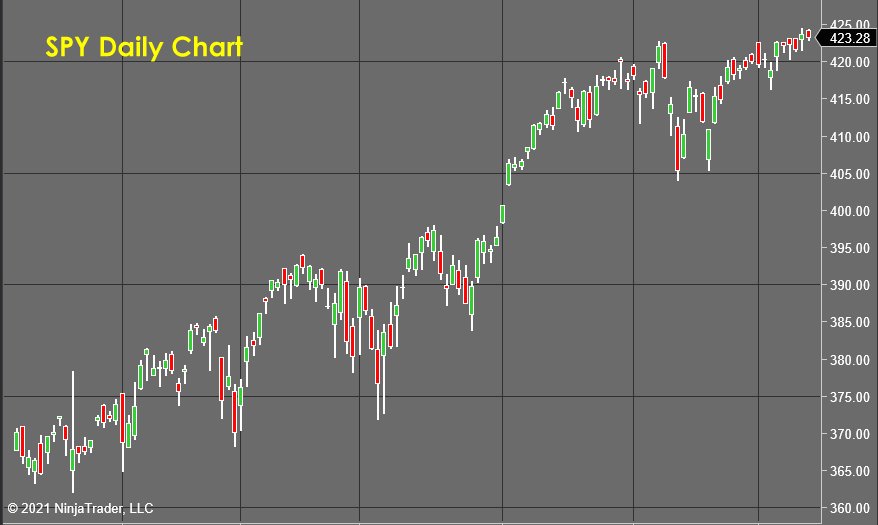

The performance of an options-based portfolio demonstrates the durability and resiliency of options trading to drive portfolio results with substantially less risk via a beta-controlled manner. The options-based approach circumvented the September 2020, October 2020, and January 2021 sell-offs while outperforming/matching the S&P 500 over the 13-month post-pandemic bull run, posting returns of 58.2% and 61.8%, respectively (Figures 1-5).

Despite these results over the past 13-plus months and 275 trades, limitations and challenges come with any trading system. Specifically, acts of nature, legislative and regulatory actions can jeopardize option trades. Here, I will walk through the five trades that resulted in losses and the underlying reasons as to why these were beyond any remediation efforts. Legislative and regulatory risks are two areas that pose some of the greatest company-specific and/or sector-specific challenges.

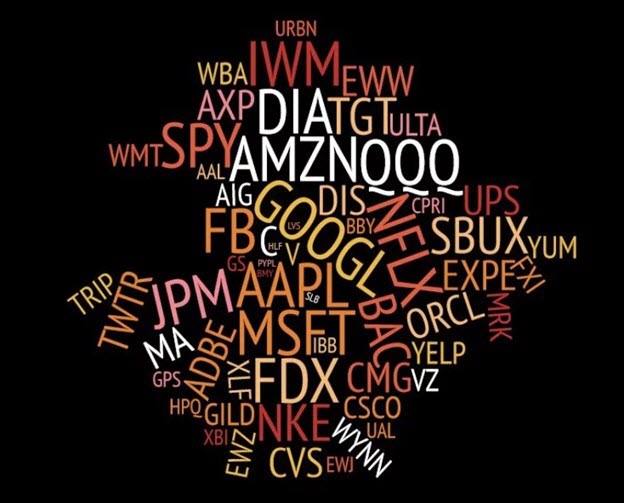

Figure 1 – Overall option tickers used from April 2020 – May 2021

Continue reading "Options: 275 Trades and 5 Losses - 98% Win Rate" →