Analysis originally distributed on April 4, 2018 By: Michael Vodicka of Cannabis Stock Trades

Warren Buffet is the most successful investor of all-time. His net worth of $84 billion makes him the third richest person in the world.

Buffet’s fortune was built on a contrarian view on investing. He once said, “Be fearful when others are greedy and greedy when others are fearful.”

This is good advice for the cannabis sector right now.

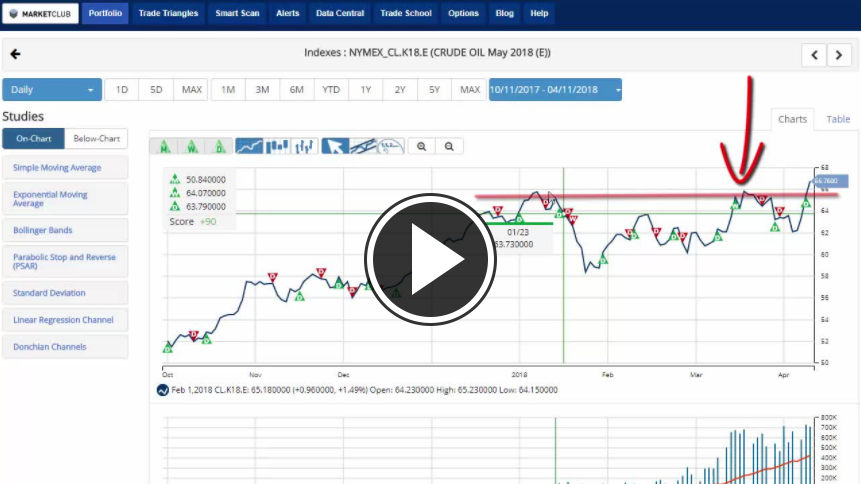

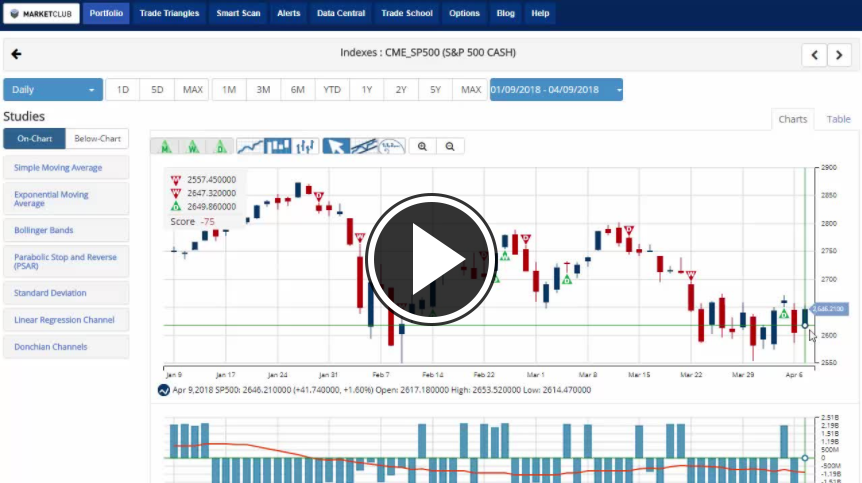

After posting huge gains in 2017, the global cannabis sector fell into a bear market in the first quarter of 2018.

However, despite that short-term weakness, the long-term picture for the cannabis industry and cannabis stocks has never looked better.

Cannabis stocks got off to a blazing start in early 2018. Since climbing to an all-time high, the sector spent most of February and March trickling lower.

The Canadian Cannabis Index fell 15% in the first quarter.

Continue reading "Two Cannabis Giants Trading 61% Below 52-Week High"

Continue reading "Two Cannabis Giants Trading 61% Below 52-Week High"