Whether you’re investing or trading in Netflix Inc. (NASDAQ:NFLX), it’s difficult to avoid a discussion surrounding an options strategy to augment this position. Netflix has an outrageous valuation and a wide range of intrinsic volatility, where swings of $10-$15 in one day are fairly common. This intrinsic volatility is more so pronounced during any major news story (i.e. expansion into international markets or subscriber price increases) and specifically around earnings announcements. As a result of the nosebleed valuation and volatility, in my opinion, options go hand-in-hand when committing capital to Netflix stock. Netflix is high growth stock thus investors are willing to pay a premium for this growth. However, the tradeoff is that traditional metrics such as the price-to-earnings multiple (P/E ratio) and the PEG ratio do not apply. Due to its rapid growth, expanding original programming, wrestling market share away from big cable companies, expansion into international markets and its overall ubiquity, it's easy to see why investors are willing to pay a premium for this media disruptor. Due to these aforementioned factors, an options strategy may be an effective way to leverage and hedge this high growth stock while mitigating risk. Netflix offers high yielding premiums on a bi-weekly or monthly basis whether one owns the stock or attempting a good entry point. This bodes well for those who are willing to leverage options trading to augment returns and mitigate risk throughout the volatile nature of Netflix’s stock. This could come in the form of covered calls and/or secured puts or a combination of call/put strategy. Netflix’s recent second earnings disappointment highlights the value of an options strategy to mitigate losses and smooth out drastic moves in the stock price. Continue reading "Trading or Investing In Netflix - Options Are Your Friend"

Author: The INO.com Team

2016: Current Market Themes

A year ago almost to the day we began tracking a ‘Macrocosmic’ theme that would eventually see gold bottom and rise vs. stocks and bonds in 2016, joining its bullish status vs. commodities, which had been in place since 2014.

Nominal gold bottomed in December 2015 before silver, commodities and stocks as a counter cyclical environment birthed a new precious metals bull market. We updated the progress here, here and here in 2016.

But markets, being the product of immeasurable moving parts, are always in motion and you cannot get too hung up on any one theme, ideology or habit. When the Semiconductor sector began burping up its positive signals for the economy and for stocks, we listened intently and I for one, put my capital where my mouth was and noted as much each week in NFTRH.

Back in April, with the first improvement in the Semiconductor Equipment sector’s bookings, we went on bull alert. By June 22, we had established a trend in the rising bookings and noted the Details Behind Semiconductor Leadership and the bullish implications that this Canary’s Canary in the coal mine carried. Continue reading "2016: Current Market Themes"

Dollar Falls As U.S. GDP Disappoints

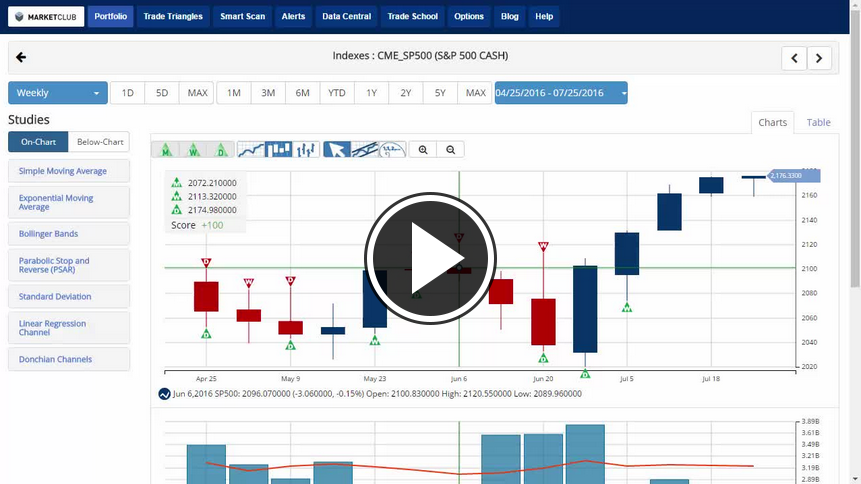

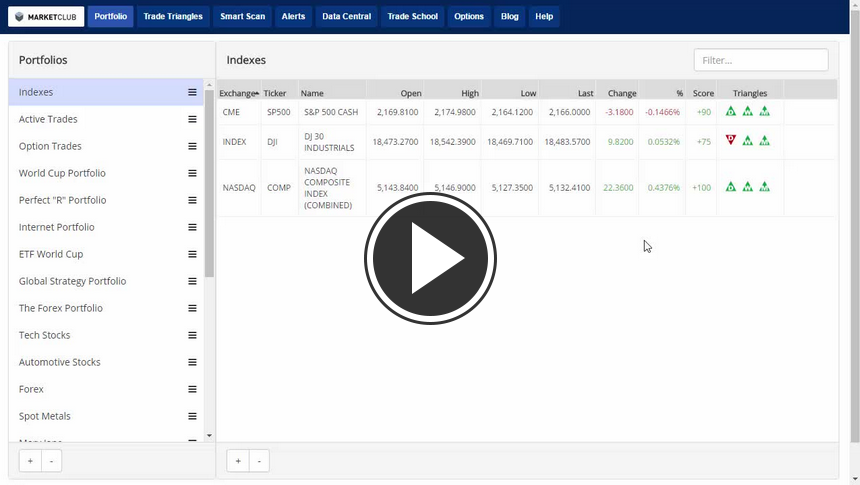

Hello MarketClub members everywhere. Once again the U.S. economy was sluggish in the spring, dashing expectations for a strong rebound after a tough winter. Stronger consumer spending was offset by weakness in housing construction and a big slowdown in the pace that businesses restocked store shelves.

The Commerce Department said Friday that the GDP grew at a 1.2% annual rate in the April-June quarter. That was far below the 2.6% GDP growth rate that economists had been forecasting.

The government also revised its estimate of first-quarter growth down to 0.8% from the previously reported 1.1%. That makes three straight quarters in which the economy has grown at a lackluster rate.

Key levels to watch next week: Continue reading "Dollar Falls As U.S. GDP Disappoints"

Trading Live Around Apple and The Fed Chickening Out...Again!!!

Well that was a crazy trading day! Come on into my trading office and I'll show you how we handled the Facebook and Apple earnings trade. Plus, we focus in on trades related to the US dollar because the Fed totally chickened out...again!!!

Learn more about TradingAnalysis.com here.

Plan Your Trade, and Trade Your Plan,

Todd Gordon

Decision Day For The Federal Reserve

Global stocks rose as Apple's results lifted technology shares, while the Yen dropped after the prime minister had signaled he was committed to a $265 billion stimulus package. Here in the U.S, Treasuries and stocks are little changed as investors await the Federal Reserve's latest assessment of the economy.

All signs point to The U.S. Federal Reserve keeping interest rates on hold today, but investors will be looking for hints about the Feds next move.

The next move is still seen as an increase in rates. But even as concerns over Brexit ease the U.S. election is drawing closer, likely pushing back action towards the end of the year and possibly limiting the Fed to a single hike in 2016, a far cry from its early-year estimate for four moves.

Key levels to watch this week: Continue reading "Decision Day For The Federal Reserve"