In Ireland, February 29 is Bachelor's Day - a traditional holiday when women propose to men. Scotland began the tradition in 1288 by passing a law permitting women to propose and if refused, the man had to pay a fine. Only in Europe.

Leap years are also election years, as every politician knows, four years is just enough time for the electorate to forget all their broken promises from last time around. Plus, we all must take a giant leap of faith when you go to the polls.

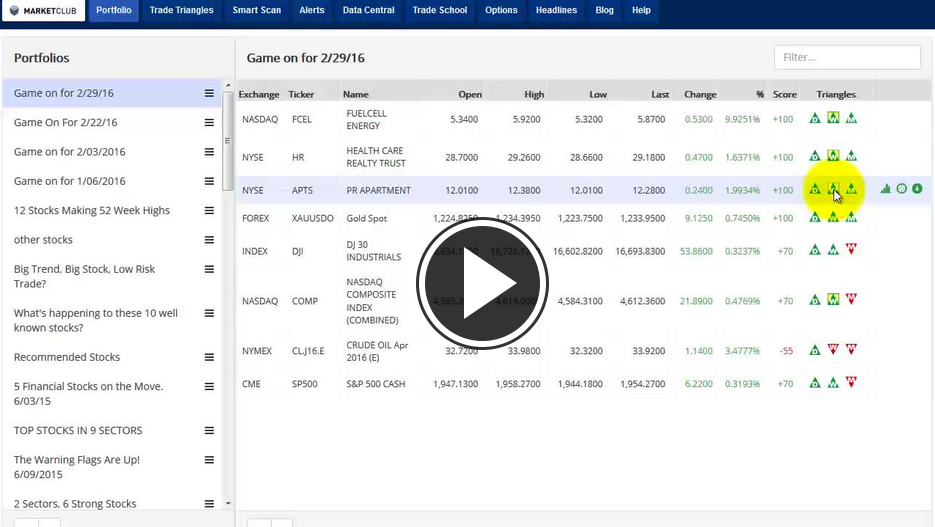

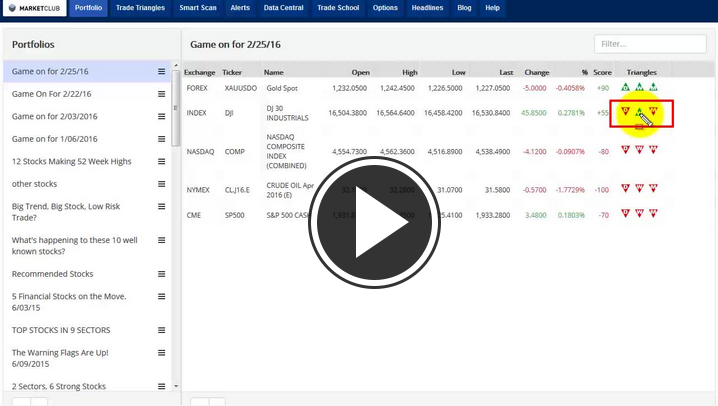

Okay, back to the markets. It is hard to believe that we are rapidly coming to the end of the second full trading month of 2016. The first two months have been extraordinarily volatile with triple digit swings becoming the norm. As we move into March, I expect to see the markets begin to settle down somewhat.

So what's trending so far in 2016? Continue reading "It's A Leap Year So Watch Out!"