George Soros has joined fellow billionaire investors Stan Druckenmiller and Ray Dalios on investing big in gold. Precious metals expert Michael Ballanger explains what is behind these moves.

This week George Soros once again came out with his very large directional "bets" for the SP 500 and for gold and, needless to say, Mr. Soros is once again shorting the SP and buying gold and gold miners, joining Ray Dalio, Stanley Druckenmiller and Michael Ballanger (just kidding) in a decidedly unpopular stance. Carl Icahn came out in agreement during a CNBC interview this week that left the interviewer near-speechless and groveling in the mud of anti-Wall Street rhetoric.

In the meantime, some of the smartest investors I know are SOOOO bullish on gold that they are buying huge baskets of penny explorers under a nickel because of the leverage contained when the public finally decides to re-allocate to include gold (and mining stocks). A fund manager I know said to me, "Must be the top!" in reference to this, but it really can't be the top after a five-month rally representing the largest recorded quarterly advance in mining shares since recordkeeping began.

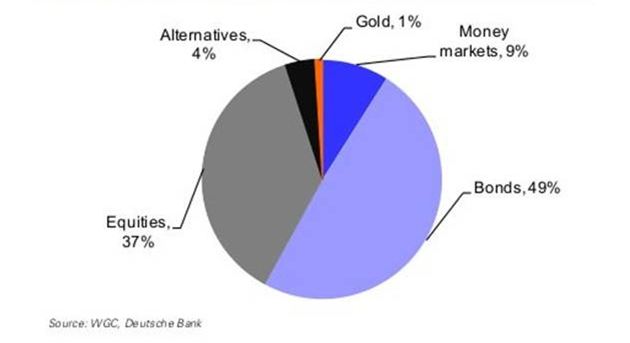

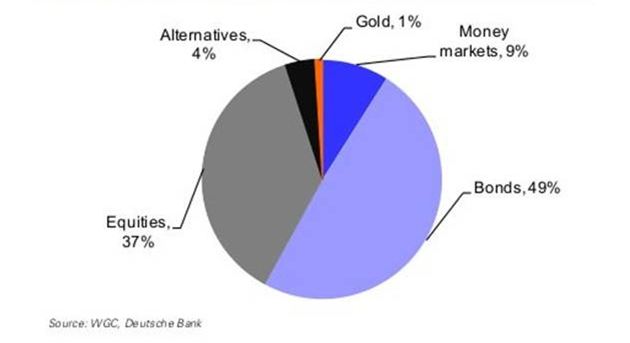

Look at the chart above and think what would happen if we were to get a shift from bonds to gold; 49% of global asset allocations reside in bonds while 1% reside in gold. Now, consider these two facts: Continue reading "George Soros Making Big Bets on Gold" →