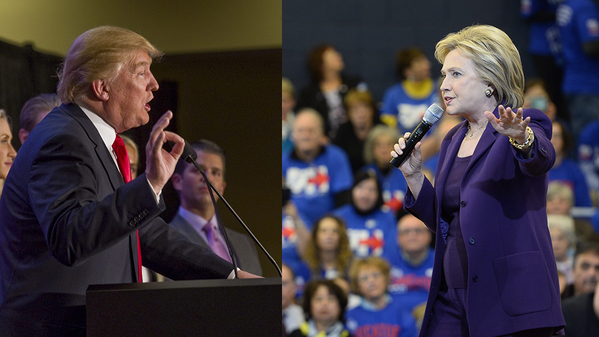

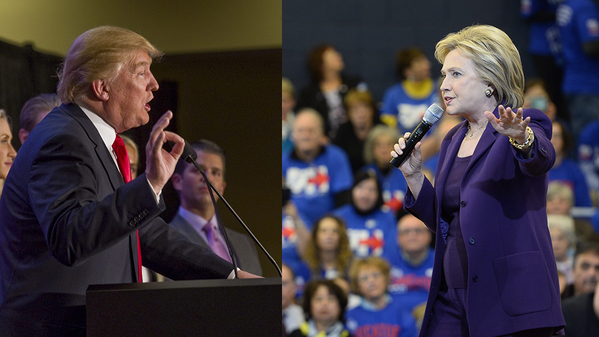

Donald Trump and Hillary Clinton may have very little in common, but Barry Allan, vice chair of mining for Mackie Research Capital, says if either moves into the White House, the U.S. dollar will fall and gold will rise. A higher gold price bodes well for gold equities, and in this interview with The Gold Report, Allan and his colleague Ryan Hanley share the names of some of their top picks for this environment.

The Gold Report: Barry and Ryan, welcome back to Streetwise Reports. I'm excited to get your thoughts on the market and a few stocks. We've had the first wave of a possible uplift in the precious metals markets. The presidential election is coming up in the U.S. in November. What do you think a Donald Trump or a Hillary Clinton win would mean for gold, gold equities and the Canadian dollar?

Barry Allan: Looking at the election from north of the border and as it pertains particularly to gold bullion, we have taken the view that either a Clinton outcome or a Trump outcome would probably lead to a weaker dollar and, hence, a stronger gold price environment. From where we sit, either of those outcomes, whether it would be Trump, which seems to be controversial to say the least, or Clinton, which would result in a much more Canada-like budget, would probably not play well for the U.S. dollar. We see either outcome as being supportive of the gold price.

We also would layer in there oil prices, which we think are probably going to go higher. That will strengthen the Canadian dollar, but it will hurt the U.S. dollar as well. We see all those things conspiring to put us in a reasonably good gold price future.

TGR: Would that bode well for U.S. investors buying Canadian mining stocks? Continue reading "President Trump? President Clinton? Gold Up In Both Scenarios" →

What do you think would be the "perfect caption" for this photograph of Senator Ted Cruz?

What do you think would be the "perfect caption" for this photograph of Senator Ted Cruz?