One of our readers asked if I would do a Gold/EUR analysis when I posted my last Gold/$ update. Today I will cover this instrument and show its comparative dynamics for a broader view from the opposite side of the Atlantic.

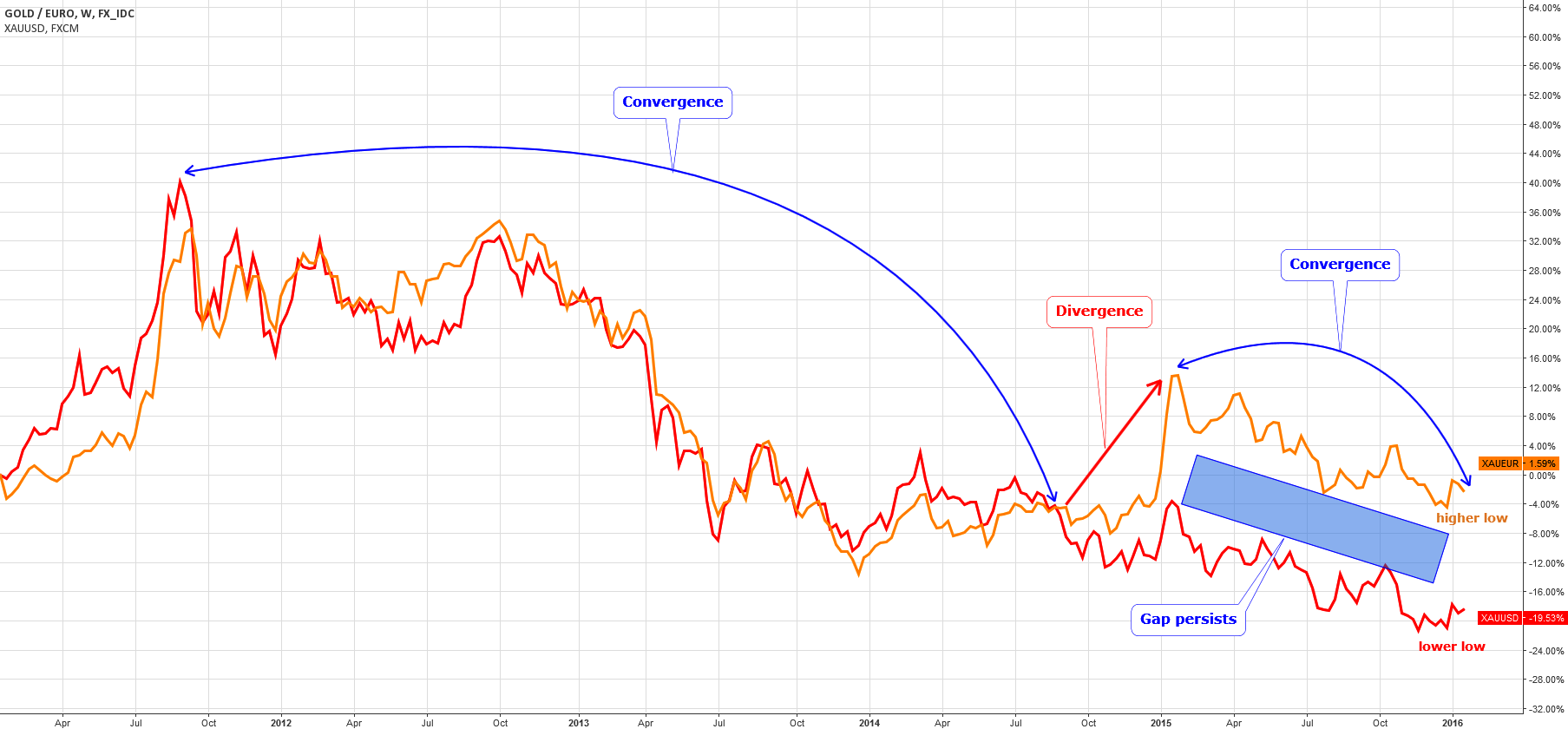

Chart 1. 5-year Comparative Dynamics: Gold/Dollar Vs. Gold/Euro

Chart courtesy of tradingview.com

As seen on the chart above, both Gold crosses have a very strong correlation over the past 5 years. Same peaks and troughs, US gold slightly overshot the European gold at all-time high in 2011; however, it proved to be short-lived.

At the end of 2014, we can see the sharp divergence of crosses (highlighted in red arrow) amid a deep devaluation of the EUR which caused a rocketing of Gold/EUR beyond the 1100 EUR mark. The elevation was short and in 2015, we saw a sharp drop back down in both markets.

There are two things worth mentioning: Continue reading "Weak Euro Keeps Gold Afloat"