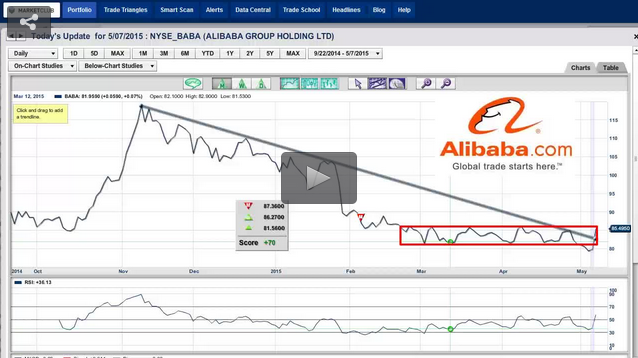

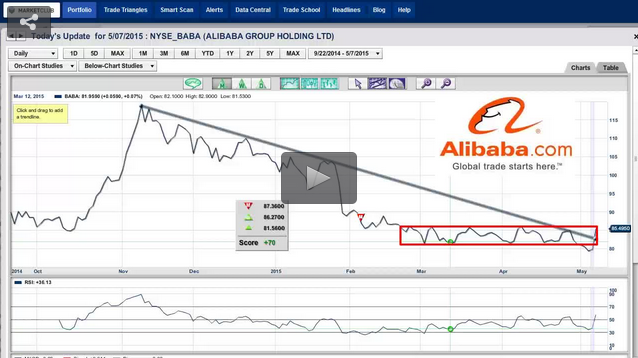

Today, I'm going to be looking at a very well-known stock that has all the tell-tale signs of having put in a major low this week. This company also just announced a new CEO, as well as a significant earnings beat.

In addition to this stock, I will also be looking at all three of the major indices. All three indices flashed warning signals yesterday to move to the sidelines.

The broad trading range that is the gold market right now continues. Today, gold experienced a sizable decline and is rapidly approaching the lower levels of its trading range.

Crude oil has taken a bit of a pause, but remains on its upside trajectory. I'm still thinking that an upside target zone of somewhere around $68-$70 a barrel is in the cards.

The dominant dollar has been losing ground against the Euro for the past four weeks. While we may see another dollar bounce, the dollar continues to look less powerful than it did just four weeks ago. I still think that the euro can go somewhat higher (1.1500) from where it is right now.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub