S&P 500 Futures

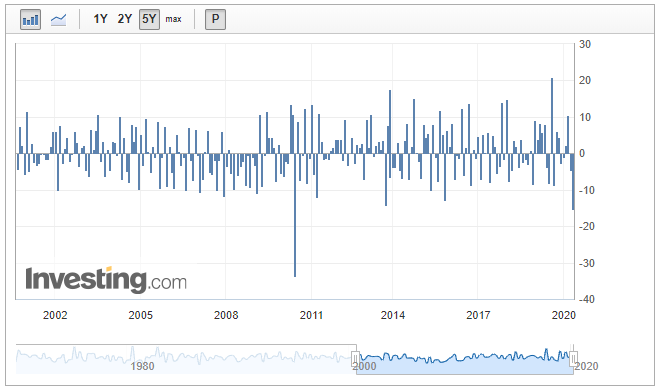

The S&P 500 futures in the June contract settled last Friday in Chicago at 2829 while currently trading at 2822, basically unchanged for the trading week. However, that is not telling you the whole story as the volatility remains exceptionally high as the Dow Jones is down over 600 points ending the week at a very sour note.

I am not involved as the volatility, and the risk/reward is not in your favor to take a bullish or bearish position. However, I do think the stock market will head higher due to all the stimulus programs. I still see light at the end of the tunnel because many states have started to open up their economies, which is a great thing to see, in my opinion. However, if you are long a futures contract, I would place the stop loss under the 10-day low standing at 2717 as an exit strategy.

There is so much uncertainty at the current time. Until the Coronavirus situation is figured out, you're going to continue to see this market flip flop daily. I am an optimist, and I think that the United States economy will come back strong in the coming weeks. I would take advantage of price weakness to enter into a bullish position. I think many individual stocks are incredibly cheap and should be looked into substantially.

TREND: MIXED

CHART STRUCTURE: IMPROVING

VOLATILITY: HIGH

Mexican Peso Futures

The Mexican Peso in the June contract settled last Friday at 3959 while currently trading at 4035 up about 75 points for the trading week still stuck in a 6-week tight consolidation as prices look to have bottomed out in my opinion as prices have absolutely collapsed over the last couple of months due to the Coronavirus situation. Continue reading "S&P 500 Futures Show A Flat Market"