A vampire needs to be invited in order to enter your house. So the story goes. But in this case, we are talking about the Macro house, with its nexus in the USA and its Central Bank.

You see, the Federal Reserve inflates money supplies as a matter of doing business, which is why I noted so strenuously in Q4 2018 that Jerome Powell’s then-hawkish stance in the face of a declining stock market made perfect sense… because the 30 year Treasury bond was not bullish; it was bearish and getting more so under the pressure of rising inflation expectations.

But now as we noted the other day the inflated Sub is losing pressure. As we noted before that Goldilocks is being threatened. Here are the updated ‘inflation gauges’ from that post, continuing to lose pressure.

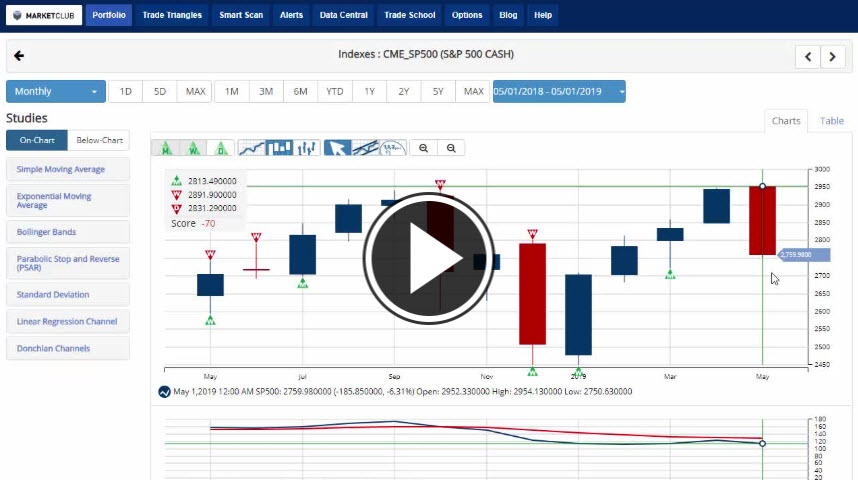

But in Q4 the Fed had a threat if its own to deal with as the repercussions of its previous inflationary operations could be exposed to the light of day by the breakout through the Continuum’s limiter if it were not arrested promptly. The orange arrow on the chart below shows the point of concern for the Fed. Continue reading "You Have To Invite The Vampire Into Your House"