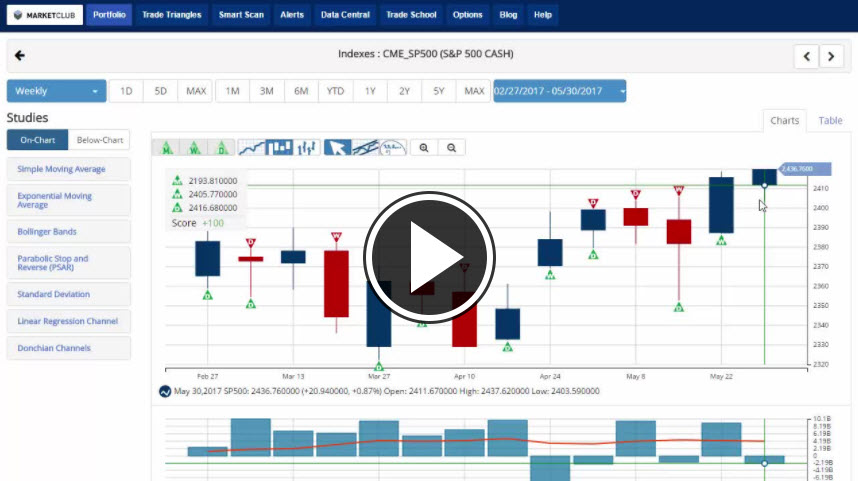

The Fed’s June rate decision is coming up this week and the consensus bets are overwhelmingly tilting towards a rate hike. According to the CBOE Fed Funds rate probability chart, the probability the Fed will raise rates at the next meeting is 91.3%. Thus, suggesting that market participants are almost certain a rate hike is coming. Furthermore, there is also growing consensus that the Fed will also start trimming its balance sheet as early September. However, a deep dive into the mechanics of the US economy suggests that the Fed should ignore the consensus, and even its own outlook, and take a step back from tightening. And it all starts with the puzzling discrepancy between inflation and housing prices.

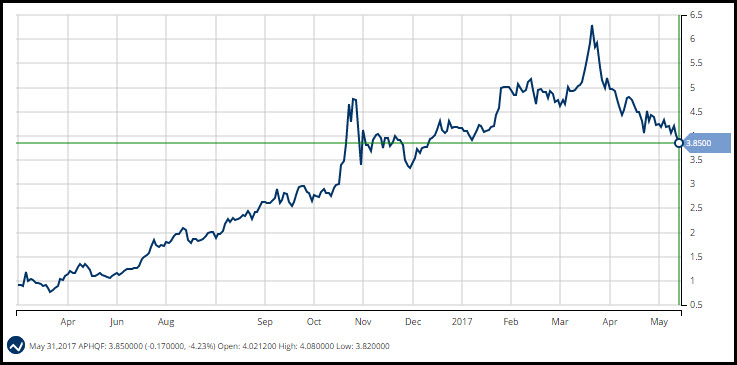

Home Prices Heat as Inflation Cools

Upon the surface, the latest fall in the US Core inflation rate, from 2.3%, four months ago to 1.9%, and the latest surge in US housing prices (as reflected by the Case-Shiller Index) present a somewhat puzzling divergence between the US inflation outlook and housing prices. Nonetheless, those two contradicting developments are closely intertwined, both to each other and to the Fed’s monetary policy. And, to illustrate the link between the two, we must dive into the US Treasury market. Continue reading "Time For The Fed To Take It Easy"