We've asked Michael Seery of SEERYFUTURES.COM to give our INO readers a weekly recap of the Futures market. He has been Senior Analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets.

Michael frequently appears on multiple business networks including Bloomberg news, Fox Business, CNBC Worldwide, CNN Business, and Bloomberg TV. He is also a guest on First Business, which is a national and internationally syndicated business show.

Crude Oil Futures

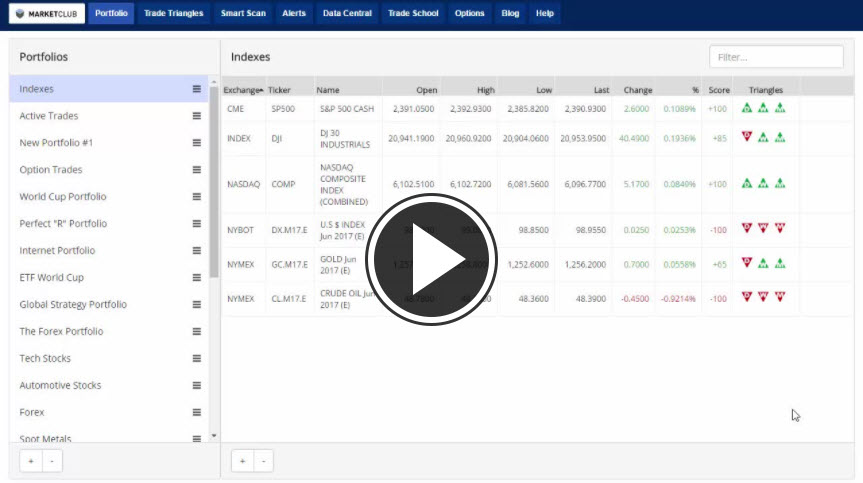

Crude oil futures in the June contract are up 60 cents this Friday afternoon in New York currently trading at 46.10 a barrel breaking the low that was hit on March 27th at 47.63 this week. I think prices could re-test the November low around the $42 level as the trend remains to the downside. Crude oil prices are trading under their 20 and 100-day moving average as the precious metals & the entire energy sector continue to be under pressure over the last several weeks. My only recommendation is a short natural gas position. The chart structure in crude oil is not that great, and I will wait for the monetary risk to be lowered. I'm certainly not advising any type of bullish position as this markets trend is negative and coupled with the fact of very poor fundamentals as worldwide supplies are massive as now the problem could be waning demand. Oil prices traded above $53 in mid April as prices have now dropped about $7 a barrel rather quickly, so let's keep a close eye on this market for a possible short position in the coming days ahead.

TREND: LOWER

CHART STRUCTURE: POOR

Continue reading "Weekly Futures Recap With Mike Seery"