Analysis originally distributed on Feburary 15, 2017 By: Michael Vodicka of Cannabis Stock Trades

I was a derivatives trader for a billion-dollar trading firm at the Chicago Board of Trade for three years in my late twenties.

It was a crazy job. My job was to make huge bets all day long in highly volatile markets.

The key to this position was the chart.

I would hunt for specific formations on the chart, looking for stocks, bonds, commodities, or currencies ready to breakout into a new high or breakdown into a new low.

Once I found the right setup I would slap on million-dollar trades looking to “scalp” the market for a quick profit.

BIG NEWS!!! We're now accepting new Cannabis Stock Trades Premium members!

This is the insanity of short-term trading and why I am now an investment advisor. You have to be nuts to gamble like that all day. Investing is a thousand times easier than trading.

However, as an investment advisor and financial writer, my background in trading is a weapon.

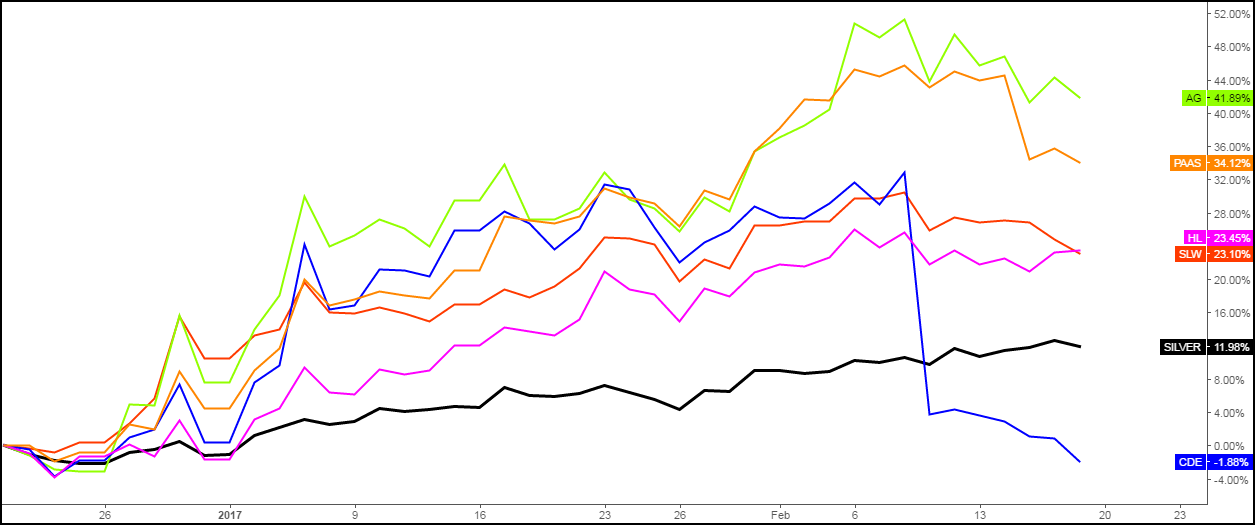

It helps me see things in the market that a lot of other advisors and investors miss. Continue reading "3 Cannabis Stocks Ready To Hit A New 52-Week High"