Copper advanced 15 cents or 7% higher from my previous post and it looks like we are going to see much more strength as it was just a warming-up.

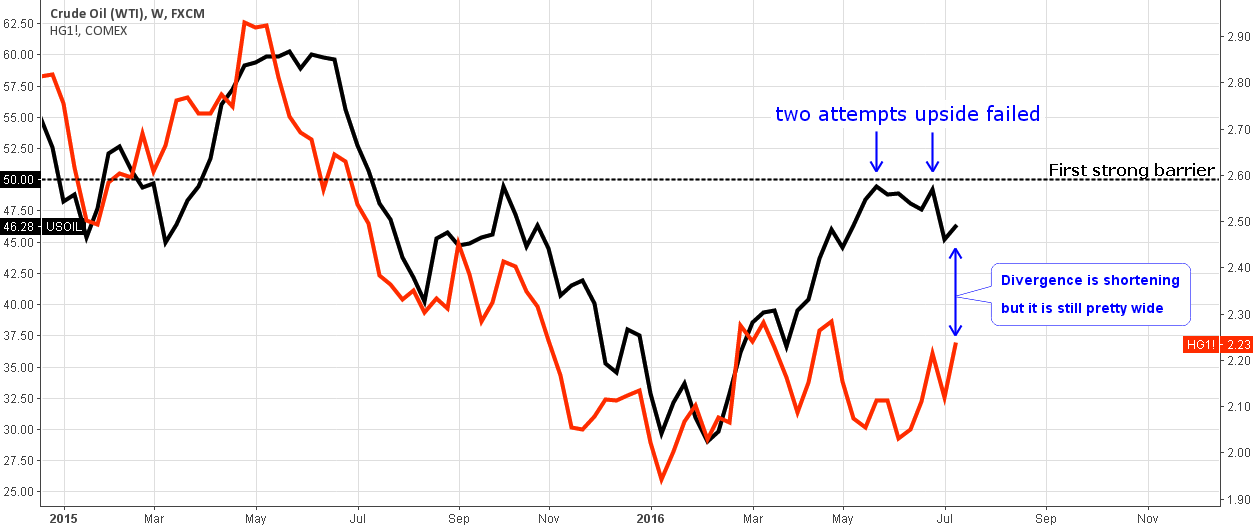

Chart 1. Copper-Oil Weekly: The Metal Tries To Catch Up Consolidating Crude

Chart courtesy of tradingview.com

The comparative chart above became a tradition. This time, there are no dramatic changes on it and the only drama here is the failure of crude oil to surpass the first strong barrier at the $50 mark (black dashed horizontal line). Oil has been stuck in a $5 range between $45 and $50 levels. We are at a crucial point as soon we will know for sure if it was a strong correction in oil before another huge drop to the $26 low or below or is it a consolidation before the break through $50 and then $60 barriers within a new uptrend. Continue reading "Freeport-McMoRan Could Double Amid Strong Copper"