Today's video contains one of the best lessons you ever will learn. It will teach you how to apply and integrate technical indicators into your trading plan. Not only will you gain a new perspective on traditional technical indicators, but you also will learn new ways to interpret some innovative indicators you that may not know about.

Today's video contains one of the best lessons you ever will learn. It will teach you how to apply and integrate technical indicators into your trading plan. Not only will you gain a new perspective on traditional technical indicators, but you also will learn new ways to interpret some innovative indicators you that may not know about.

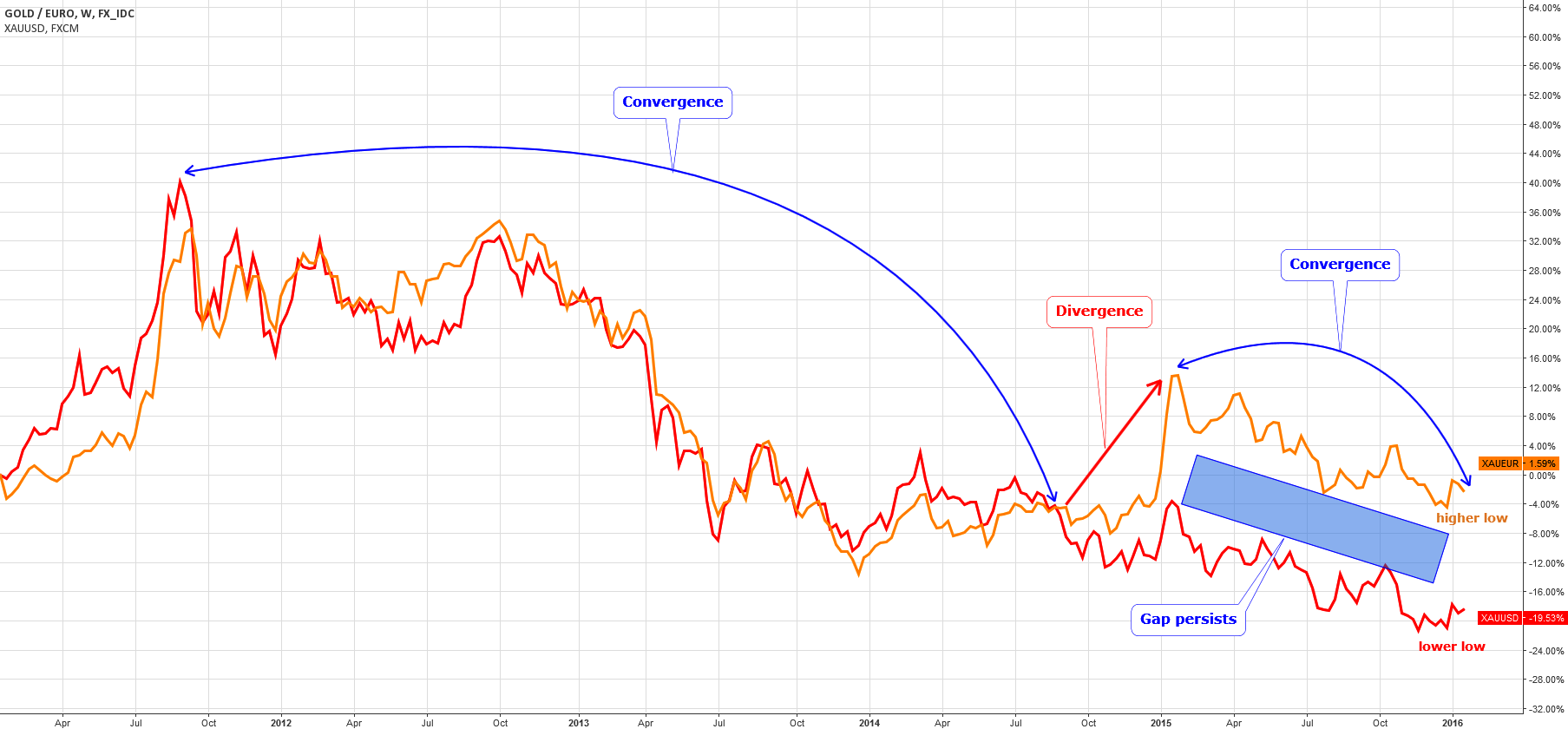

Along with that, you'll pick up, at least, two valuable new insights on the principles of momentum interpretation, and you will discover some of the major weaknesses that plague many of today's most commonly used indicators.

WATCH NOW: Getting New Insights From Old Indicators

Best,

The INOTV Team