We've asked Michael Seery of SEERYFUTURES.COM to give our INO readers a weekly recap of the Futures market. He has been Senior Analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets.

Michael frequently appears on multiple business networks including Bloomberg news, Fox Business, CNBC Worldwide, CNN Business, and Bloomberg TV. He is also a guest on First Business, which is a national and internationally syndicated business show.

Crude Oil Futures

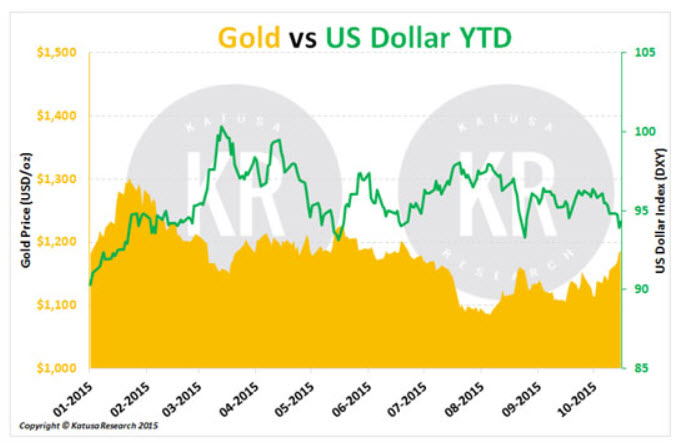

Crude oil futures in the December contract are trading below its 20 and 100 day moving average hitting an eight week low in Tuesdays trade only to rebound in Wednesdays trade off of a bullish API report as prices remain choppy as I’m currently sitting on the sidelines just like I have been in many different markets as there are very few trends that are currently developing. Crude oil prices settled last Friday in New York at 44.60 while currently trading at 46.18 slightly higher for the trading week as the U.S dollar is at an eight week high putting pressure on many commodities especially the precious metals over the last several days, but it looks to me that crude oil prices are stabilizing around the mid-40 level. Continue reading "Weekly Futures Recap With Mike Seery"