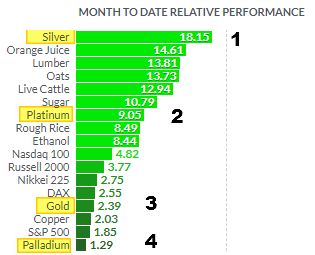

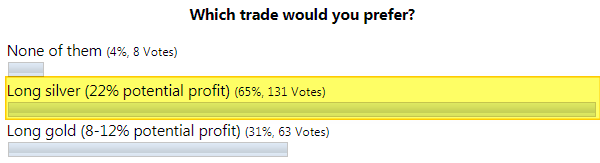

I was watching top metals closely as their price dynamics didn’t convince with sharp zigzags up and down, which are more appropriate during market consolidations, not trends. When silver hardly tagged the former top on the 1st of July, I got cautious. So, this post is aimed to share with you a warning alert for top metals as I spotted a Bearish signal on the silver chart. I will start with its daily chart below to show you the details.

Chart courtesy of tradingview.com

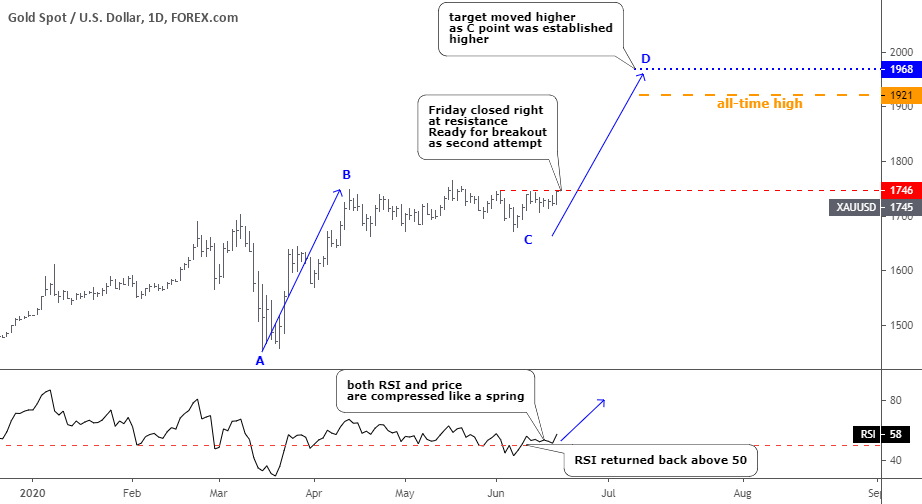

“Silver was a gamechanger” in April as then it finally revealed its structure with a sharp drop and the following V-turn, which indeed changed the game for both top metals since then. This time again, it shows a leading Bearish indicator ahead of gold. Continue reading "Silver Could Take Gold Down With Bearish Divergence"