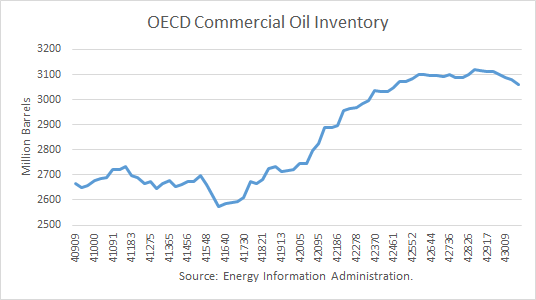

The Energy Information Administration (EIA) published its Short-Term Energy Outlook (STEO) for January, and for the first time provided its projections for 2018. After all of the hype about the OPEC production cut, it may come as a surprise that the EIA is projecting a rise in global oil inventories in 2017 and 2018.

Specifically, the EIA had estimated that OECD oil stocks ended at 3.101 billion barrels at the end of 2016. It's forecasting them to rise further to 3.127 and 3.158 billion at the end of 2017 and 2018, respectively. The 5-year ending average as of December 2014, before the glut started, was 2.666 billion. Continue reading "Global Oil Glut To Build Through 2018, EIA Says"