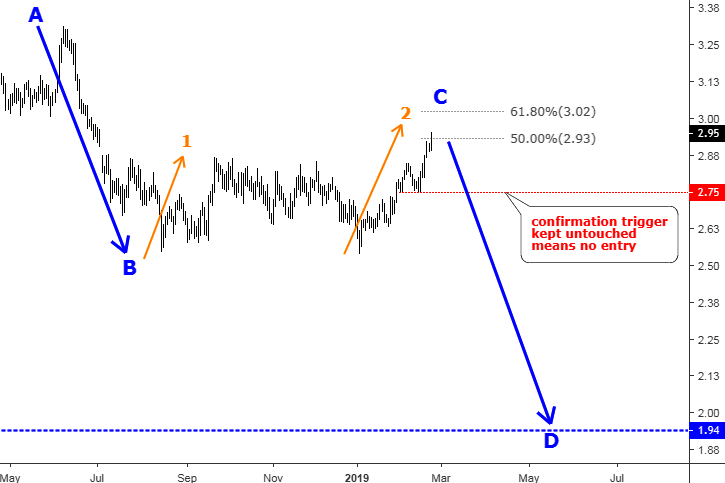

So, dear traders, our patience was finally rewarded last week. Copper has provided us an even better opportunity as the price climbed higher to make a deeper retracement and the distance of the drop is now even greater. We started from the $2.75 level, then we moved higher to $2.885, but none of them were activated.

I spotted the famous reversal pattern on the chart, which adds to my structure analysis and I will show it in the chart below.

Let’s go through the trade setup steps again as the entry signal was triggered.

Step 1. Chart Analysis and Step 2. Trading Idea

These steps can be skipped as we already know what we are looking for.

Step 3. Trade Setup

We should prepare a Sell Setup to enter the trade using specific entry, stop and take profit levels. These are the things that make a trade. If you don’t have all three levels in your mind, you better avoid trading as it would become mere gambling. Continue reading "Copper Triggered A Short Entry"