Hello traders everywhere. Stocks are on the rise for the fourth straight day which is mostly due to signs of progress in U.S.-China trade talks which has given the market optimism. Officials from the United States and China ended their talks in Beijing that lasted longer than expected and officials said details will be released soon, raising hopes that an all-out trade could be averted.

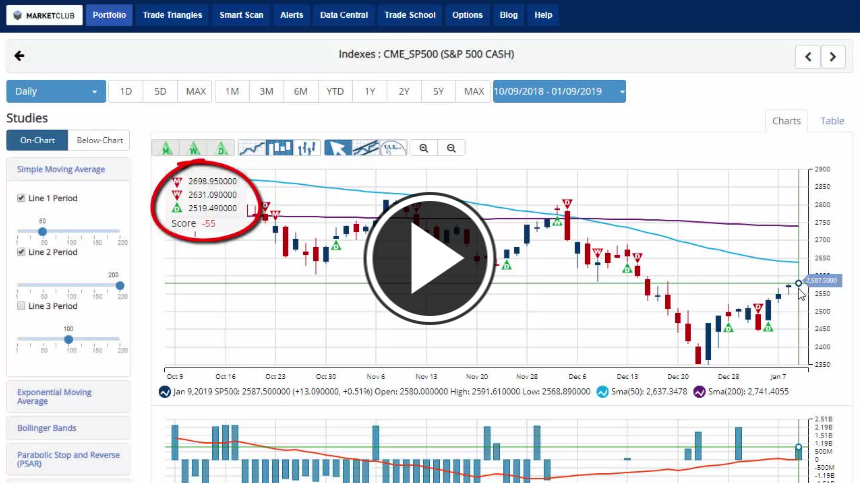

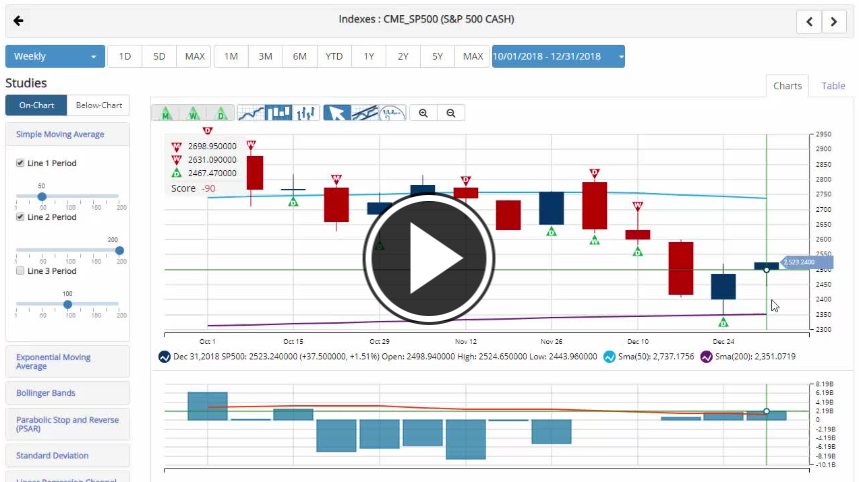

Hopes of a trade deal between the world's two largest economies, strong U.S. jobs data and Federal Reserve chair Jerome Powell's dovish remarks on interest rates have helped lift the S&P 500 9.7% from the 20-month low it hit around Christmas, but we're still waiting on a green weekly Trade Triangle which would indicate a move to a sidelines position. The NASDAQ just issued a new green weekly Trade Triangle moving to a sidelines position. The DOW is currently about 54 pts away from issuing a green weekly Trade Triangle, will we see that today?

Crude oil is up for the eighth session issuing a new green weekly Trade Triangle today at $51.78 indicating that a short-term long position is in order. Traders shrugged off bearish data on U.S. stockpiles focusing on OPEC production cuts and U.S.-China trade talks. Saudi Energy Minister Khalid al-Falih on Wednesday reaffirmed that production will fall to 10.2 million barrels per day this month, down from an all-time high 11.1 million bpd in November. Saudi Arabia will export 7.2 million bpd in January and 7.1 million bpd in February, according to Falih. Continue reading "Stocks Up For The Fourth Day"

I was going to look around to see if I could find a media article out there (complete with a TA trying to sound really important) that would be appropriate to be made fun of in our little Men Who Stare at Charts series. But then I decided to create my own chart, stare at it a little, post it and talk about it (hopefully not too self-importantly).

I was going to look around to see if I could find a media article out there (complete with a TA trying to sound really important) that would be appropriate to be made fun of in our little Men Who Stare at Charts series. But then I decided to create my own chart, stare at it a little, post it and talk about it (hopefully not too self-importantly).

As the New Year approaches us with hopes anew, here's to wishing you and your family a wonderful year ahead.

As the New Year approaches us with hopes anew, here's to wishing you and your family a wonderful year ahead.