Hello traders everywhere. The three major indexes fell Friday, on pace for their worst week since December, after data showed hiring growth slowed significantly in February. The declines came after data from the Labor Department showed U.S. nonfarm payrolls rose a seasonally adjusted 20,000 in February, missing economists' expectations of 180,000 new jobs.

Still, the report wasn't all doom and gloom. The unemployment rate ticked down to 3.8% from 4% a month earlier, while wages rose 3.4% from a year earlier, the strongest pace since April 2009.

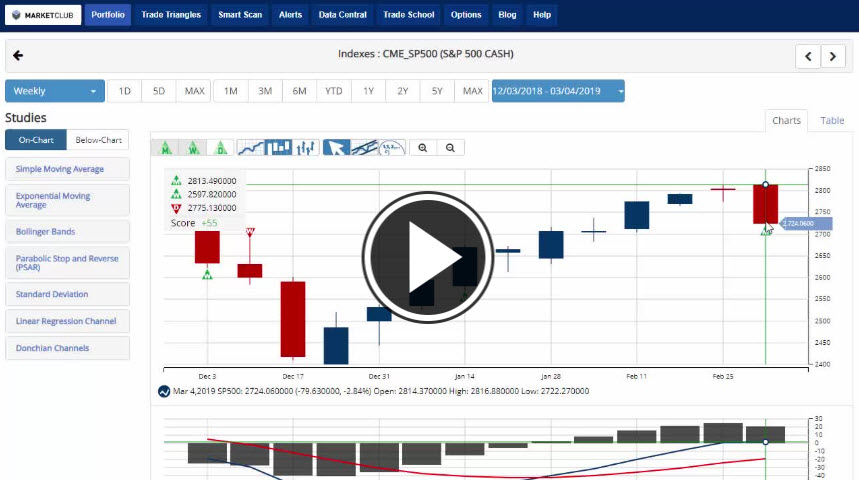

For the first time since December, all three indexes will post weekly losses over -2.6%. The DOW did finish last week with a slight loss of -.02%, the s&P 500 had a weekly loss of -.22% in January, but this will be the first weekly loss for NASDAQ, breaking a 10-week winning streak. Both the S&P 500 and NASDAQ issued green monthly Trade Triangles recent, but the DOW remains in a sideline position with a red monthly Trade Triangle. Continue reading "Stocks Fall On Weak Jobs Report"