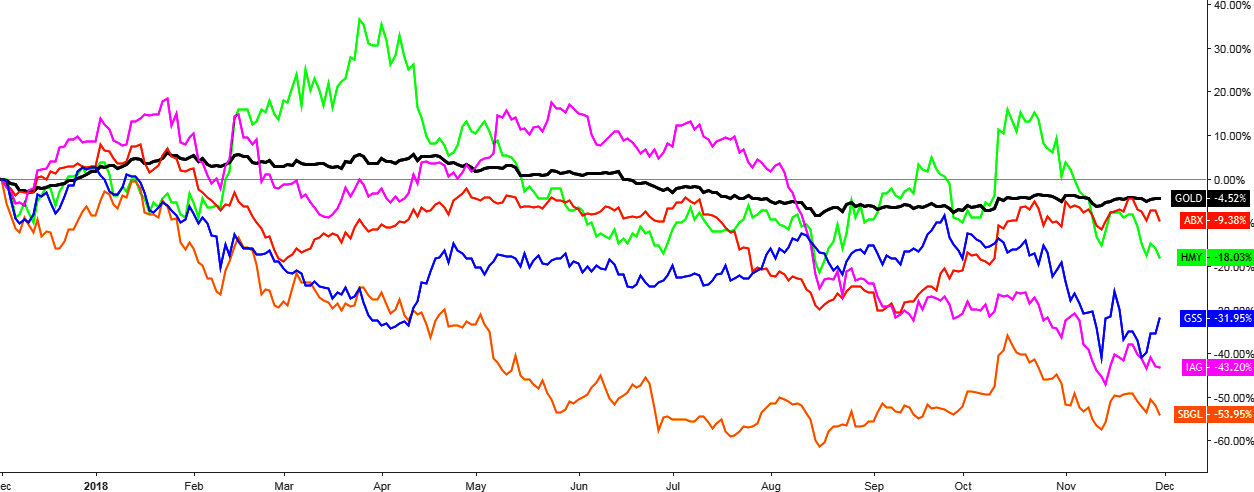

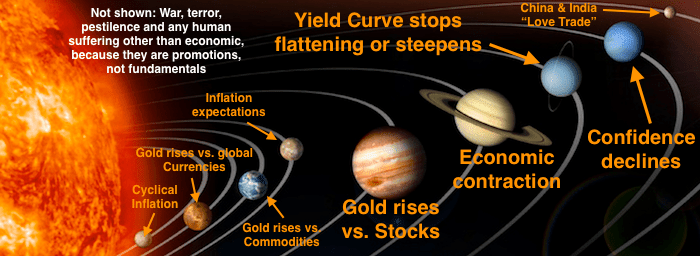

The macro has moved through a time of moderately rising inflationary concerns when economies were cycling up, many commodities were firm and risk was ‘on’. Contrary to the views of inflation-oriented gold bugs, that was not the time to buy gold stocks.

As I have belabored again and again, the right time is when the inflation view is on the outs, gold is rising vs. stock markets, the economy is in question, risks of a steepening yield curve take center stage (the flattening is so mature now that steepening will be a clear and present risk moving forward) and by extension of all of those conditions, confidence declines.

Well?…

In short, the improving sector and macro fundamentals I’ve been writing about for a few months now continue to slam home as the cyclical world pivots counter-cyclical. And what do you know? Gold stocks are reacting as they should. Well, it’s about time, guys!

The technicals had already made some constructive moves as noted in an NFTRH subscriber update on December 4th. The update concluded as follows… Continue reading "Gold Stocks Acting As They Should"