When do you think is the best time to buy a home security system?

Would it be after someone breaks into your house or before?

Of course, it would be before you are burglarized. After the fact doesn’t help you prevent a loss.

When looking at a market crash, the same rule applies.

The best way to prepare for a market crash is beforehand.

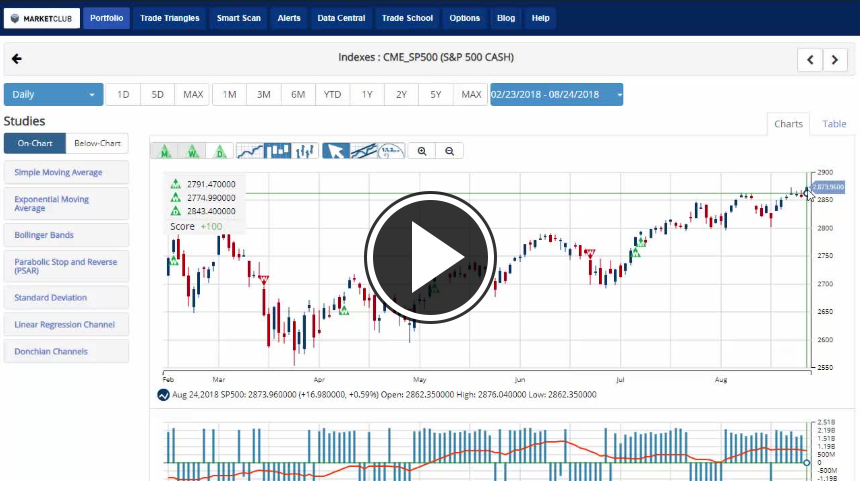

I've just added my Bear Market Blueprint training to MarketClub Options - my full and comprehensive options training course.

The Bear Market Blueprint covers…

- 7 methods I use to protect my money during a market crash.

- How to make money when the market crumbles.

- The buy and hold strategy we used to triple our 401K account.

- And much more…

In my training, I'll walk you through this blueprint and show you the plan that MarketClub Options will put in place when the market shifts.

Learn More About MarketClub Options

Sincerely,

MarketClub Options