In this post I would like to share with you the analysis of the stocks with a name starting with letter “B”. There are more stocks to choose from this time, according to the earlier mentioned filter criteria. Four stocks were shortlisted this time as they have clearer chart structure, but only two stocks reached the “well done” level. I witnessed again and again that U.S. stock market offers a lot of opportunities for investors and traders.

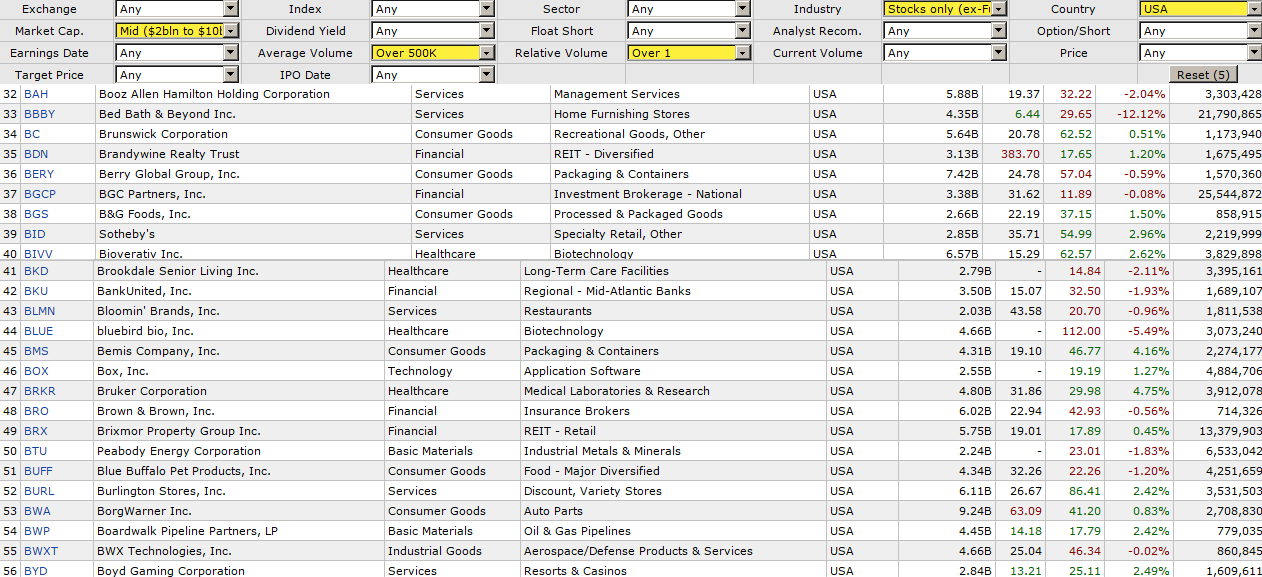

Below is the long list for letter “B”.

Table 1. Selected stocks for letter B

Out of 24 filtered stocks I picked only four as they have clear chart structure: BBBY, BGCP, BWA and BYD. BBBY is oversold and has the potential for the long trade setup, but one should wait for the breakout of the multi-month downtrend, and try not to guess the bottom, which is always risky. Others have potential short trade setups. BYD, like BBBY is also not ready and continues upside. As I told you many times before, we shouldn’t be biased. I am neither a Permabear nor a Permabull, however only short setups have appeared recently on the chart radar. Continue reading "Stock Analysis From A To Z: Letter "B""