INO Health & Biotech Stock Guide

Preview Issue #7 - December 29, 2016

BIOTECH, HEALTH & PHARMA NEWS

President-elect Donald Trump has thrown cold water on the recently volatile healthcare cohort as he voiced concerns on rising drug prices. The Trump rally continues to power on as the S&P 500, Nasdaq and Dow Jones continue to break all-time highs on what seems like a daily occurrence. Since Trump voiced his concerns over drug pricing the rally has largely left healthcare related stocks (pharmaceutical companies, pharmacies and wholesalers) behind the overall rise in the broader markets as of recent. The entire cohort has seen significant gains as traders viewed a republican controlled government in positive light with regard to this sector. However after recent comments from Donald Trump regarding the drug pricing debate much of these gains have been relegated to the pre-Trump rally levels. This optimistic perspective has faded after Donald Trump stated “I’m going to bring down drug prices” and “I don’t like what has happened with drug prices”. The iShares NASDAQ Biotechnology Index (Ticker: IBB) has been on a rollercoaster since the day just prior to the presidential election posting a broad range of movement from ~$247 to $293 or a 46-point swing (19% move). Investors were factoring-in a healthcare-friendly government in terms of scrutiny on the merger and acquisition front, deregulation, potential restructuring of the Affordable Care Act and a move favorable tax and repatriation rates throughout the industry. This sentiment has taken a breather to the time being.

WHAT'S NEXT

Recently, the federal government passed a major piece of legislation that bodes well for the industry. This legislative passage of the 21st Century Cures bill is a preverbal commitment by the government that they stand behind the efforts of industry and government in curing and treating diseases. The 21st Century Cures bill cleared the House and Senate and is aimed at easing FDA drug and device approvals and includes funds for NIH, cancer moonshot and a precision medicine initiative. This bill should provide an industry-friendly regulatory backdrop for drug and medical device companies moving into the near future. This bill provides $6.3 billion that supporters say will spur medical innovation, speed access to new drugs, expand access to mental health treatment and battle the opioid epidemic in America. The bill had widespread bipartisan support, including the backing of the Obama administration. Critics of the bill contend that it provides huge handouts to the biotech and pharmaceutical industries. Taken together, this bill in concert with a perceived pro-industry government coming to fruition should provide a tailwind for companies in this space.

INDUSTRY OUTLOOK

The drug pricing debate is clearing not going away anytime soon and will likely persist into the new administration. Donald Trump has made that clear during his interview with Time Magazine for his Person of the Year award. Pharmaceutical executives seem to have taken note of this and are attempting to get out in front of the issue. Brent Saunders (CEO of Allergan) has lead the charge in this movement. He vowed to limit drug price increases to single-digit percentages once a year. This seems to be working to some extent with Novo Nordisk falling in-line with a similar commitment. “We hear from more and more people living with diabetes about the challenges they face affording healthcare, including the medicines we make,” Jakob Riis, Novo Nordisk's U.S. president. “This has become a responsibility that needs to be shared among all those involved in healthcare and we’re going to do our part.” If drug companies self-regulate and get this drug pricing issue behind them along with the absence of political uncertainty may continue to provide a much needed lift to the sector.

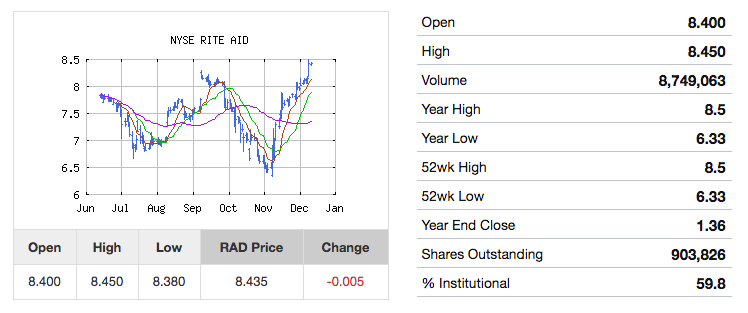

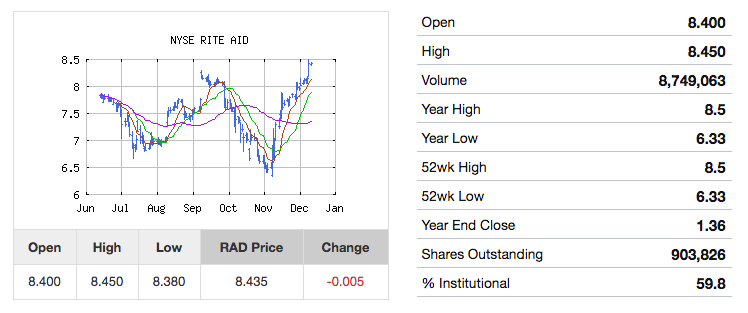

FEATURED STOCK / ETF - Rite Aid (RAD)

ABOUT THE EDITOR - Noah Kiedrowski

I am biotechnology professional with a diverse scientific background and detailed knowledge in many therapeutic areas such as monoclonal antibodies, immunotherapies and antivirals. I have a personal interest in finance, investing, trading and global markets. My analysis is focused on stocks and exchange traded funds (ETFs) while exploring niche opportunities such as derivative trading via options. This newsletter is intended to provide investors with the latest developments and trends regarding the overall healthcare sector with a biotechnology emphasis. I'll be highlighting sector trends, merger and acquisition activity, noteworthy current events, political developments and drug approvals. My focus will be centered on well-established mid-cap and large-cap companies as well as utilizing appropriate ETFs as proxies for sector trends. This is a bi-monthly newsletter service that reflects my own opinions and analyses. This newsletter is not intended to be a recommendation to buy or sell any stock or ETF mentioned. I am not a professional financial advisor or tax professional, rather an individual investor who analyzes investment strategies and disseminates my analyses. I encourage all investors to conduct their own research and due diligence prior to investing.

---

This bi-monthly newsletter service reflects the opinions and analyses of INO Contributor, Noah Kiedrowski. This newsletter is not intended to be a recommendation to buy or sell any stock or ETF mentioned. Kiedrowski is not a professional financial advisor or tax professional, rather an individual investor who analyzes investment strategies and disseminates his own analyses. All traders and investors should conduct their own research and due diligence prior to investing.