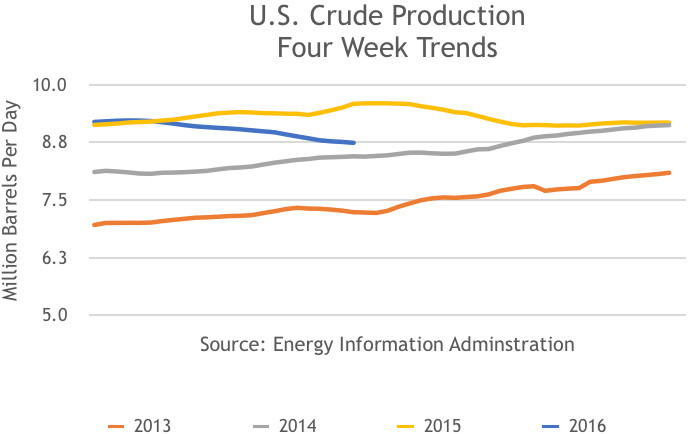

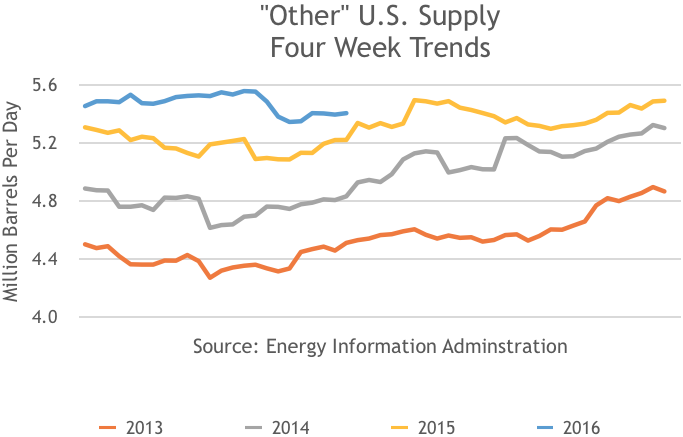

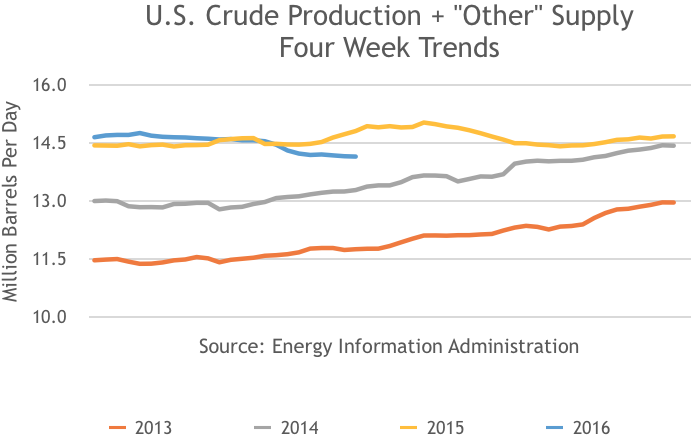

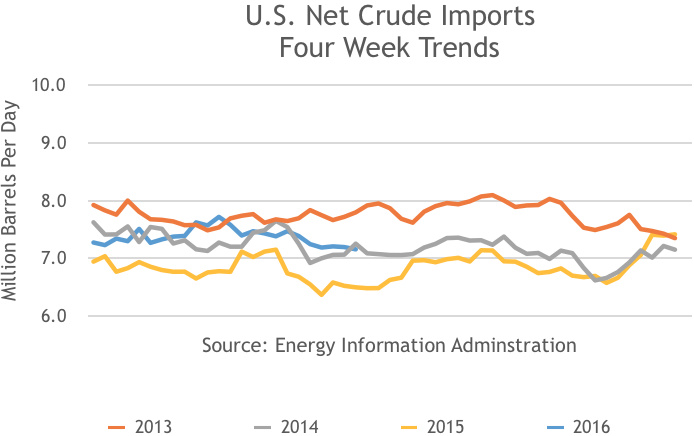

Each week, the Energy Information Administration (EIA) reports estimates for crude oil and petroleum products. These supply, demand and inventory estimates are used by traders to assess the inventory surplus (or deficit), the supply-demand balance and whether the market is tightening or not. The best measure of the latter is to look at the crude stock change and petroleum product stock change graphs.

These stocks and trends are best understood in perspective and so comparisons are made to previous years. Interpreting the data reported by the EIA might otherwise be difficult or time-consuming.

It is important to note that these estimates are provided from surveys and EIA models and are subject to revision. The EIA crude production data, in particular, has been revised substantially in monthly data released a few months after the weeklies.