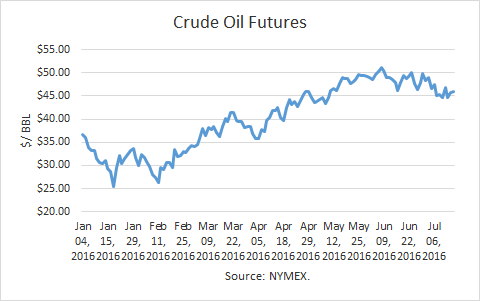

August crude futures prices edged $0.20 higher in the week ending July 12th (to correspond to the data below), closing at $46.80. However, prices are down about 7% since early June when a confluence of events caused supply disruptions in multiple locations.

Though U.S. crude oil inventories have dropped more than 20 million barrels since the end of April, petroleum product stocks reached a new peak in the week ending July 8th. Continue reading "Speculators' Risk Assessments Key to Crude Price Changes"