This week we have a stock market forecast for the week of 2/13/2022 from our friend Bo Yoder of the Market Forecasting Academy. Be sure to leave a comment and let us know what you think!

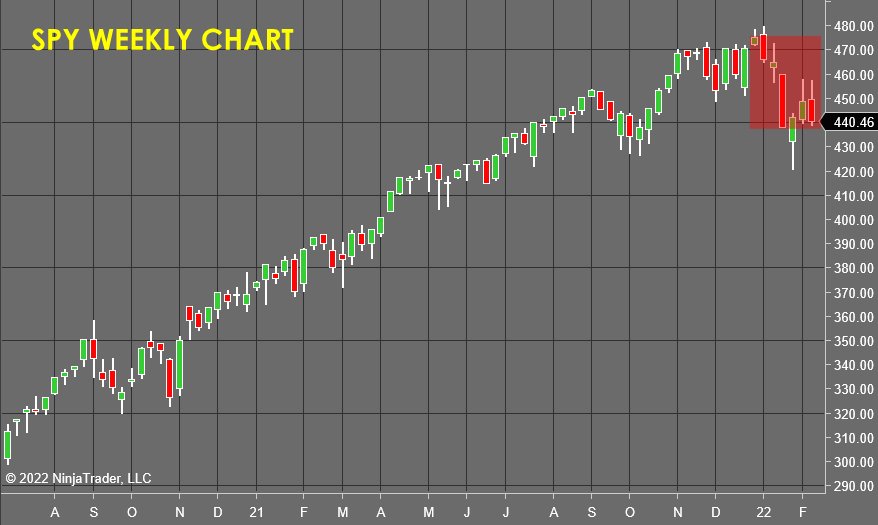

The S&P 500 (SPY)

After literally years of watching the S&P 500 top out, correct about 10%, then running in a straight line back to highs due to the Fed printing money. I think this is the lower high that I have been waiting for. As I have stated before, the Fed is losing control of the economy, and if this is true, then this is the best short entry available.

This short trade will live or die based on the action of the Fed, but if I'm right and this is the moment in history where the "pump" fails, the downside potential will be VERY rich.

It's time... now, let's see how wacky things get over the next couple of weeks. As the old Chinese saying goes, "may you live in interesting times"! Continue reading "Weekly Stock Market Forecast"