Federal Reserve Chairman Jerome Powell indicated that the central bank is likely to begin withdrawing some of its stimulatory monetary policies before the end of 2021. However, the Chairman did note that he still sees interest rate hikes off in the distance. In the Fed’s annual Jackson Hole, Wyoming, symposium, Powell said the economy has reached a point where it no longer needs as much monetary policy support.

Thus, the Fed will likely begin cutting the amount of bonds it buys each month before the end of the year, so long as economic progress continues. Based on statements from other central bank officials, a tapering announcement could come as soon as the Fed’s Sept. 21-22 meeting. Despite this pivot, it does necessarily mean rate increases are looming.

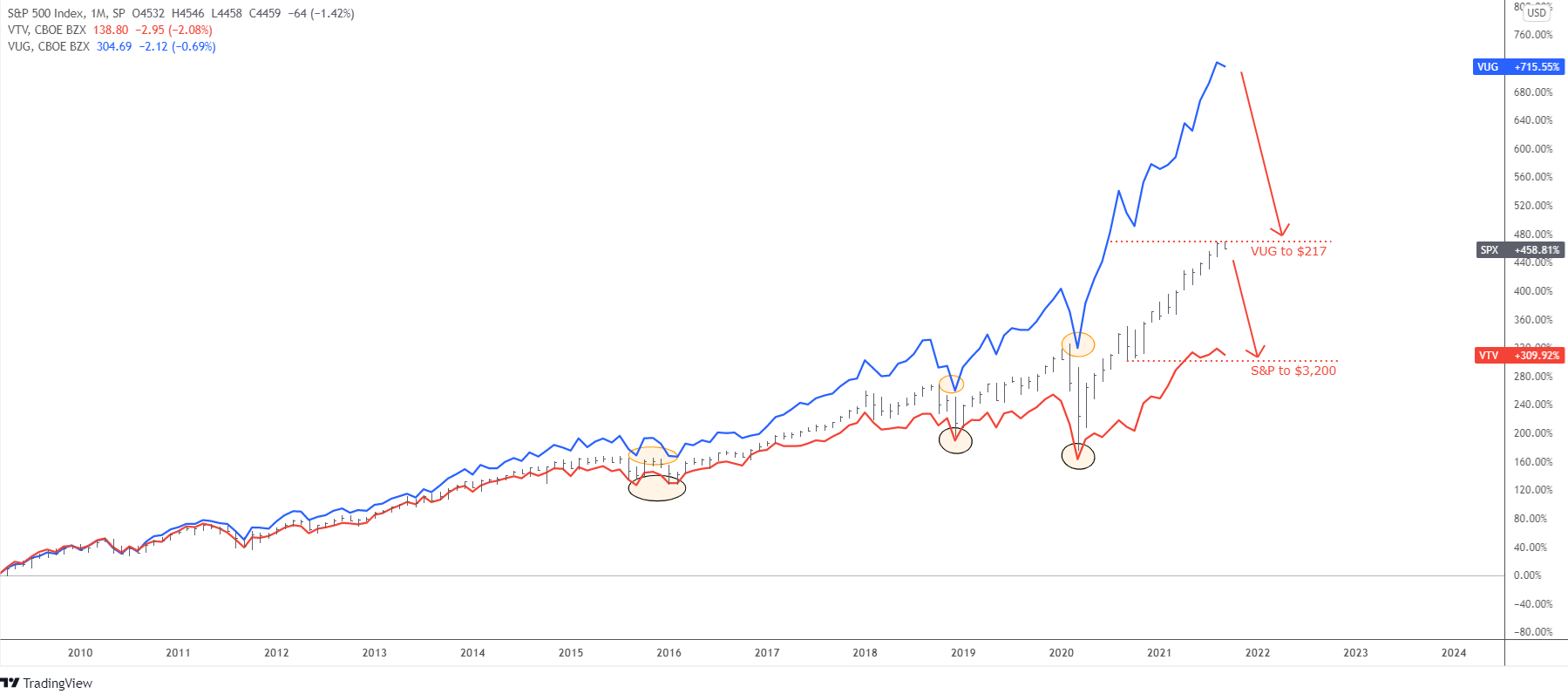

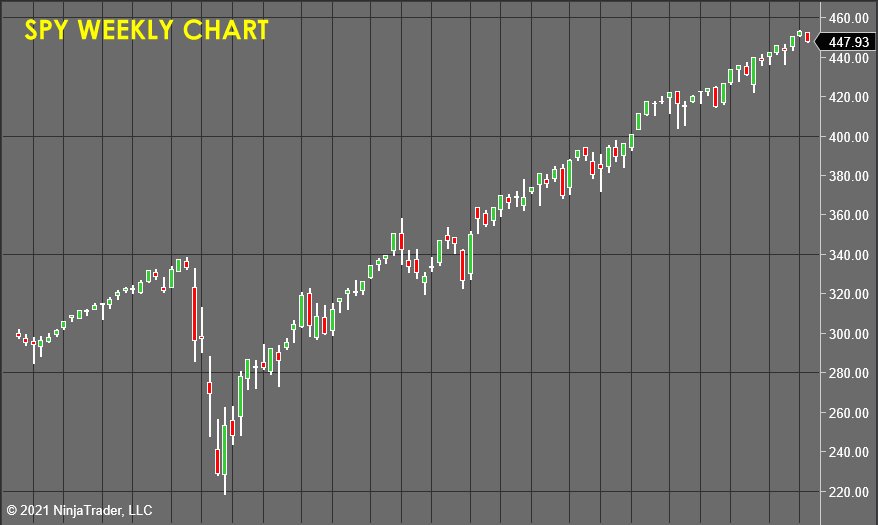

This pivot in monetary policy by the Federal Reserve sets the stage for the initial reduction in asset purchases and downstream interest rate hikes. As this pivot unfolds, risk appetite towards equities hangs in the balance. The speed at which rate increases hit the markets will be in part contingent upon inflation, employment, and of course, the pandemic backdrop. Inevitably, rates will rise and likely have a negative impact on equities.

Rates Hikes

Jerome Powell stated, “The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff, for which we have articulated a different and substantially more stringent test,” He added that while inflation is solidly around the Fed’s 2% target rate, “we have much ground to cover to reach maximum employment,” which is the second prong of the central bank’s dual mandate and necessary before rate hikes happen. Continue reading "Jackson Hole: The Fed Taper"