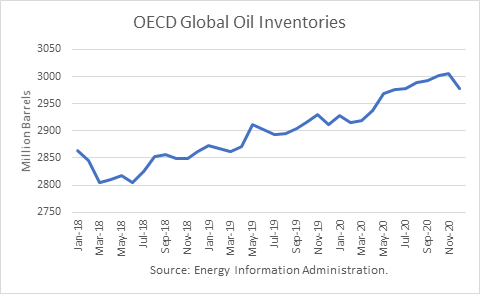

The Energy Information Administration released its Short-Term Energy Outlook for September, and it shows that OECD oil inventories likely bottomed last June 2018 at 2.805 billion barrels. It estimated stocks edged 1 million barrels higher in August to 2.895 billion, 43 million barrels higher than a year ago.

For the balance of 2019, OECD inventories are projected to rise, on balance. The third quarter seasonal stock draw was over in July. Third-quarter stocks are projected to rise by 2 million, instead of the seasonal draw. And stocks are projected to rise by 6 million in the fourth quarter, ending the year at 2.911 billion barrels, 50 million more than at the end of 2018. For 2020, EIA projects that stocks will build 67 million barrels to end the year at 2.978 billion.

The EIA has confirmed that OPEC production edged higher (23,000 b/d) in August v. July. It is also estimating that OPEC production will average about 29.6 million in 2020, and that figure is about 400,000 b/d higher than OPEC’s August estimate of the call (demand) for OPEC oil in 2020. Continue reading "World Oil Supply And Price Outlook, September 2019"