We've asked Michael Seery of SEERYFUTURES.COM to give our INO readers a weekly recap of the Futures market. He has been Senior Analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets.

Michael frequently appears on multiple business networks including Bloomberg news, Fox Business, CNBC Worldwide, CNN Business, and Bloomberg TV. He is also a guest on First Business, which is a national and internationally syndicated business show.

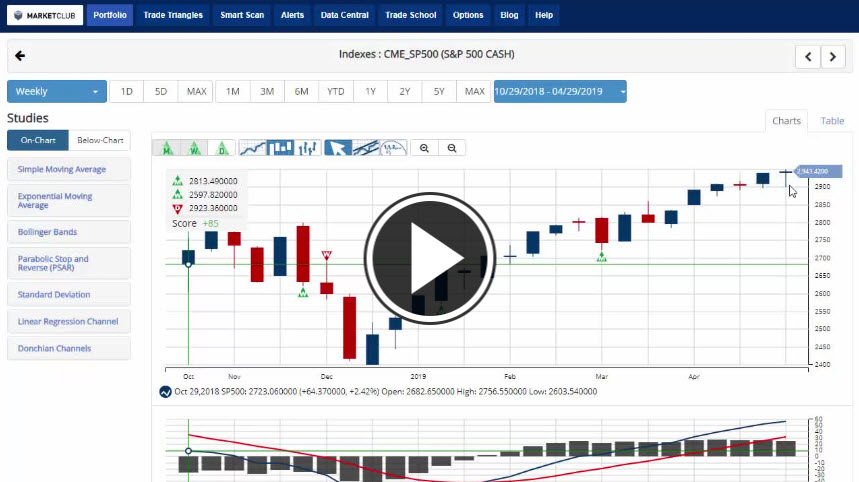

S&P 500 Futures

The S&P 500 in the June contract settled last Friday in Chicago at 2941 while currently trading at 2939 unchanged for the trading week, but ending on a positive note up over 20 points due to the incredibly strong monthly unemployment number which was released this morning. The economic figures that have been released in the last week have been impressive as we had a 3.2% first-quarter GDP and now we added 263,000 jobs with an unemployment rate of 3.8% as I see further growth in the U.S. economy and higher stock prices. I have been talking about the S&P 500 for months, and I still believe we will continue the bullish trend as 3000 is my next level of resistance. If you are long a futures contract, I would continue to place the stop loss under the 2 week low standing at 2899. However, the chart structure will not improve so you will have to accept the monetary risk. The volatility in the S&P remains historically low especially at these elevated prices as I see no reason to be short as the U.S. economy is astonishing at the current time. The S&P 500 is trading far above its 20 and 100-day moving average telling you that the trend is to the upside, but for the bullish momentum to continue, we have to break the May 1st high of 2961 which was also the all-time high which I think will be breached possibly in next weeks trade.

TREND: HIGHER

CHART STRUCTURE: EXCELLENT

VOLATILITY: LOW

Continue reading "Weekly Futures Recap With Mike Seery"