We've asked Michael Seery of SEERYFUTURES.COM to give our INO readers a weekly recap of the Futures market. He has been Senior Analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets.

Michael frequently appears on multiple business networks including Bloomberg news, Fox Business, CNBC Worldwide, CNN Business, and Bloomberg TV. He is also a guest on First Business, which is a national and internationally syndicated business show.

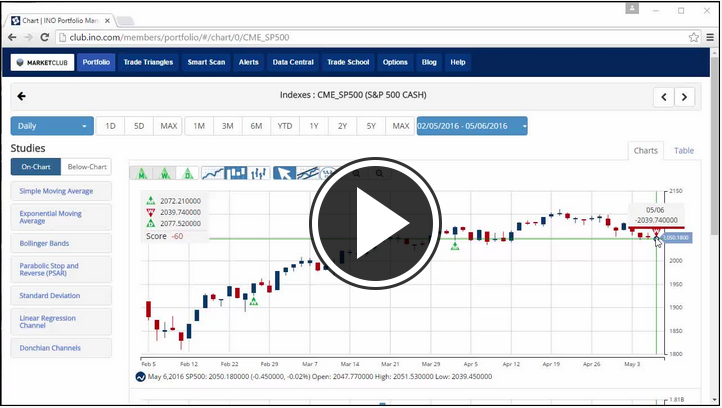

S&P 500 Futures

The S&P 500 futures in the June contract settled last Friday in Chicago 2059 while currently trading at 2040 right near a 4 week low and if you have been following any of my previous blogs you understand that I do not trade this very often. However, the setup is starting to become favorable as I want to keep a close eye on a possible short position next week. The S&P 500 is trading below its 20-day but still above its 100-day moving average as we are right near major support I do want to see the chart structure to tighten up as the 10 day high is 2094 risking around 55 points or 2,800 per contract plus slippage and commission which is too high of monetary risk to enter at this point. The monthly unemployment report was released this morning stating that the United States added about 160,000 new jobs below expectations with the unemployment rate at 5% having little impact on today’s price as I will keep a close eye on this market as volatility should definitely start to increase as the old saying states “sell in May and go away” as that’s exactly what’s happened so far. Continue reading "Weekly Futures Recap With Mike Seery"