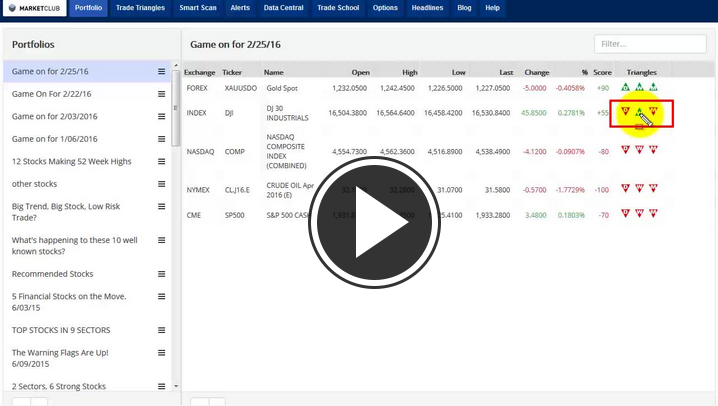

Almost two months into 2016 and the stock market isn't sending investors much news to cheer about. The S&P 500 is down roughly 6% year-to-date and global economic concerns regarding a lack of growth and record low oil prices means that volatility is high and investors are skittish.

While high growth sectors like energy and industrials are suffering, defensive sectors finally have their moment to shine. But not all defensive sectors are performing as well as expected in the current environment. Consumer staples, generally a sector that does well when the broader averages are doing poorly, doesn't have much to offer investors. The Consumer Staples Select Sector SPDR ETF (PACF:XLP) is up marginally at only 1%. However, there's another defensive sector is enjoying the performance spotlight. Continue reading "Ride The Prevailing Winds With This Utility Play"