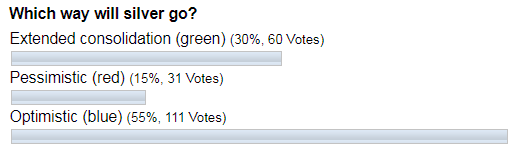

Last month I shared with you “Three Options To Go” for silver price, namely “Optimistic”, “Pessimistic” and the sideways option called “Extended consolidation” on one chart. Below are your bets for each option.

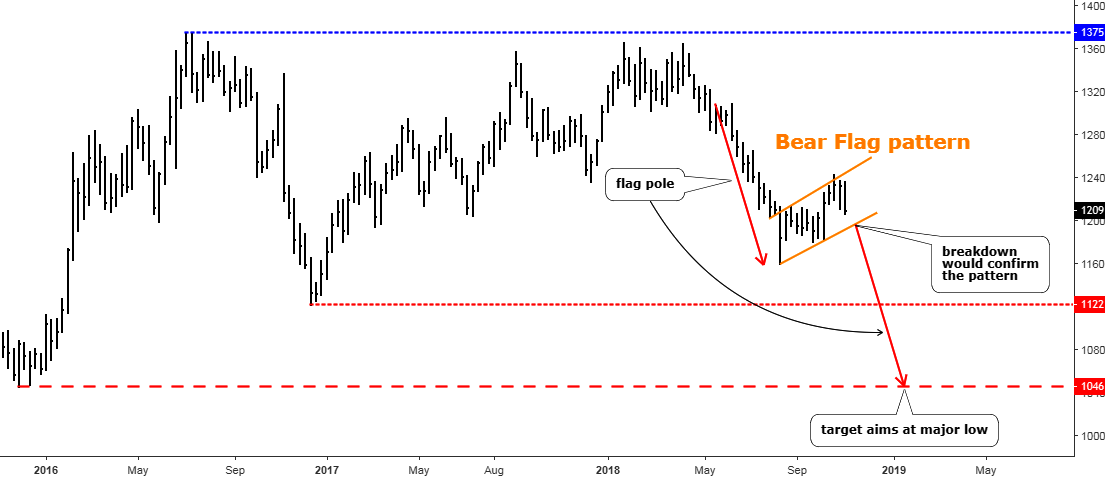

Most of you chose the “Optimistic” option where silver should continue to the upside after completing the correction. It’s a rare case when the minority was right as the “Pessimistic” scenario played out the next week after the post. The metal’s price dropped into the abyss at $11.64, reaching the 11-year low in the price area of distant January 2009. I think this move surprised not only me, although I said that it could reach $11 area, but even those who clicked the right answer as it was so quick as price sank within a few weeks from $16.66 for 30%!!!

Silver just can’t stop surprising us as it suddenly changes from latency mode to explosion mode and back, again and again.

The interesting thing happened next Continue reading "Silver Is A Game Changer"