In January of 2018, we noted a cyclical leader (Semiconductor Fab Equipment) in trouble: Semi Canary Still Chirping, But He’s Gonna Croak in 2018.

We also ran a series of articles featuring the happy-go-lucky 3 Amigos (of the macro) in order to gauge a point when larger herds of investors would become aware of cyclical issues facing the global (including the US) economy. Each Amigo (SPX/Gold Ratio, Long-term Treasury yields, and a flattening Yield Curve) would ride with the good times but signal an end to those good times when reaching destination (Amigos 1 & 2 got home but #3, the Yield Curve is still out there). Here is the latest Amigos status update from October: SPX/Gold, 30yr Yields & Yield Curve.

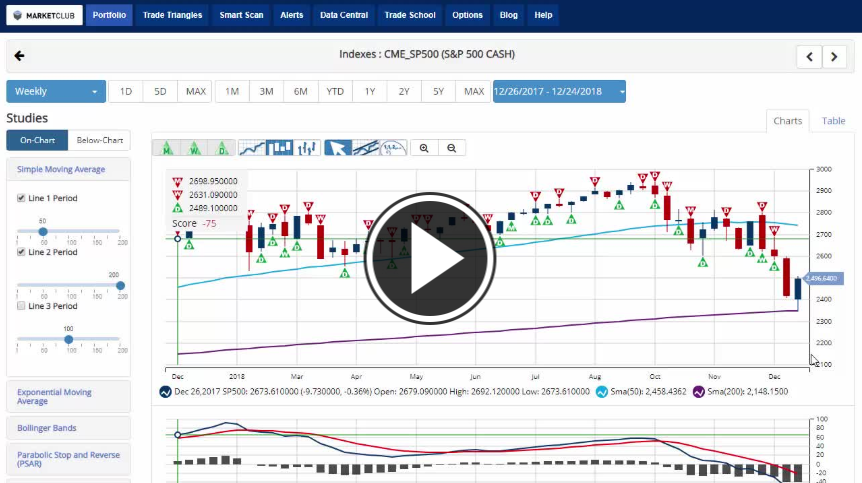

Today I would like to stick with a cyclical macro view, but do so through a lens filtered by the ultimate counter-cyclical asset, gold. As market participants, we are lost if we do not have road maps. That is why we (NFTRH) gauged Semi Equipment vs. Semi (and Tech), the unified messages of the macro Amigo indicators and many other breadth and cyclical indicators along the way to safely guide us to Q4 2018, which has been a challenge for many, but business as usual for those of us who were prepared.

But gold, which all too often gets tied up in an ‘inflation protection’ pitch by commodity bulls, is one of the best signalers of a counter-cyclical backdrop as its best characteristic is that of value retention and capital preservation. Gold, being outside the constellation of risk ‘on’ assets does not pay any income, does not leverage good economic times and does not inherently involve risk because it is a marker of stable value. Hence its underperformance during cyclical good times (leverage and all) and its outperformance during troubled counter-cyclical times.

So let’s take an updated look at gold vs. various cyclical items Continue reading "Cyclical Assets Vs. Gold"