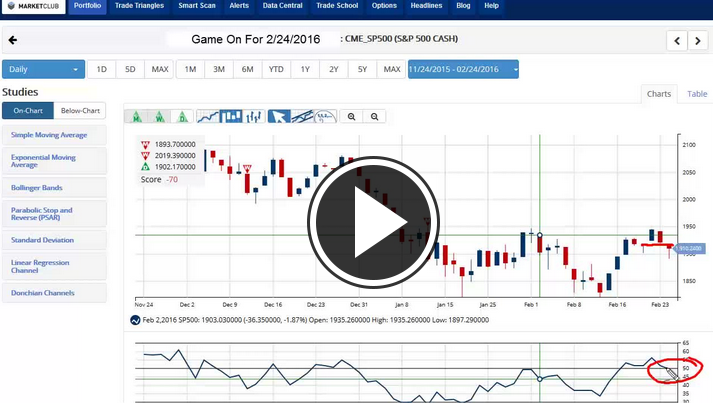

The recent rally abruptly came to an end yesterday as the market reversed down from key resistance levels. It takes a lot to reverse a major trend in any market and that's why I have been bearish for quite some time on many of the big stocks. Based on the Trade Triangle technology, I feel that we are going to see continued downward pressure on the markets.

One of the outstanding features of a bear market is that they don't let you out easily. Anyone who bought stocks in the last few days thinking that the market was going to go back up to the highs are now trapped holding losing positions. Continue reading "Reality Comes Back With A Vengeance"