Whether you’re investing or trading in Netflix Inc. (NASDAQ:NFLX), it’s difficult to avoid a discussion surrounding an options strategy to augment this position. Netflix has an outrageous valuation and a wide range of intrinsic volatility, where swings of $10-$15 in one day are fairly common. This intrinsic volatility is more so pronounced during any major news story (i.e. expansion into international markets or subscriber price increases) and specifically around earnings announcements. As a result of the nosebleed valuation and volatility, in my opinion, options go hand-in-hand when committing capital to Netflix stock. Netflix is high growth stock thus investors are willing to pay a premium for this growth. However, the tradeoff is that traditional metrics such as the price-to-earnings multiple (P/E ratio) and the PEG ratio do not apply. Due to its rapid growth, expanding original programming, wrestling market share away from big cable companies, expansion into international markets and its overall ubiquity, it's easy to see why investors are willing to pay a premium for this media disruptor. Due to these aforementioned factors, an options strategy may be an effective way to leverage and hedge this high growth stock while mitigating risk. Netflix offers high yielding premiums on a bi-weekly or monthly basis whether one owns the stock or attempting a good entry point. This bodes well for those who are willing to leverage options trading to augment returns and mitigate risk throughout the volatile nature of Netflix’s stock. This could come in the form of covered calls and/or secured puts or a combination of call/put strategy. Netflix’s recent second earnings disappointment highlights the value of an options strategy to mitigate losses and smooth out drastic moves in the stock price. Continue reading "Trading or Investing In Netflix - Options Are Your Friend"

Category: INO.com Contributors

BoJ Ready for Helicopter Money?

Helicopter money, that’s the big talk in the past week. The term helicopter money refers to a case where the government hands out money to citizens and funds it through printed money. The last time helicopter money was relevant was back in 2009. That’s when Ben Bernanke, then Federal Reserve Chairman, literally opened up the printing press and poured massive amounts of liquidity into the bond market, in tandem with a massive fiscal stimulus plan from the US government. Now, investors are speculating that the BoJ is ready to unleash a similar move, in coordination with the Abe government. And with the BoJ monetary policy meeting scheduled for this Friday, investors have high hopes. Are these hopes in place?

Kuroda Vs. Abe

In the past several months, BoJ watchers have been routinely underwhelmed by the BoJ’s statements. The BoJ slashed deposit rates to -0.5% and increased its QE program to a whopping ¥80 Trillion. But since those two announcements deflation has returned, yields on Japanese Government Bonds plunged to record lows and Japan’s GDP growth marked a modest 0.1% annually. And still, no monetary bazookas have been announced. Continue reading "BoJ Ready for Helicopter Money?"

Heat Wave To Cut Natural Gas Storage Glut

The National Oceanic and Atmospheric Administration's (NOAA) Climate Predict Center (CPC) is forecasting a continuation of a major heat wave this week ending July 30th. Nearly every single state is predicted to experience higher than normal temperatures. In some states, such as Washington and Oregon, cooling degree days (CDDs) are forecast to be more than double their normal levels. However, in the two states that burn the most natural gas at power plants, Texas and Florida, the heightened temperatures will be more muted.

Forecast

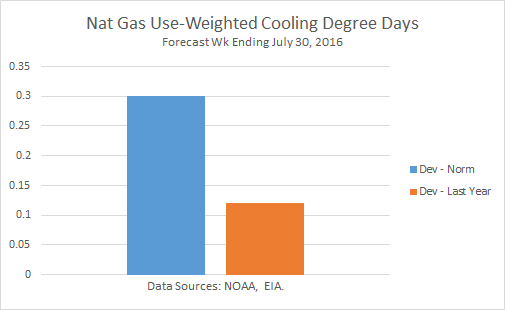

Based on NOAA's state-by-state cooling degree day forecast, weighted by natural gas-weighted electricity production, I estimate that CDDs will be 30% higher than normal and 12% higher than in the same week last year.

For the year-to-date, cumulative CDDs are 22% higher than normal but the same as than during the year-to-date in 2015. Continue reading "Heat Wave To Cut Natural Gas Storage Glut"

When Did Market Stability Become A Fed Mandate?

According to the Federal Reserve Act, in which Congress created the Federal Reserve System back in 1913, the U.S. central bank was given the following statutory objectives for conducting monetary policy: maximum employment, stable prices and moderate long-term interest rates.

The Fed has since given itself an additional mandate: market stability. Congress didn’t grant the Fed that power, but that seems to be the Fed’s overriding concern lately. In the process, it’s succeeded in creating what some very smart people believe is the biggest bond bubble of all time, and a pretty big one in equities, too. It’s pushed more and more of the country’s wealth into the pockets of the so-called 1%. It’s also given some people a false sense of financial security that the Fed has created a floor – a guaranteed return, if you will – under which investment returns will not be allowed to fall. Continue reading "When Did Market Stability Become A Fed Mandate?"

McKesson Jumps 34% Off Lows - Now What?

Introduction

McKesson Corporation (NYSE:MCK) fell to a 52-week low back in February and has since surged 34%, appreciating from $148 to ~$200 per share as of mid-July. On February 16th, I published an article titled “McKesson Has Hit A 52-Week Low – Buying Opportunity” positing that McKesson has put in place a string of positive shareholder friendly maneuvers to position itself for future growth and break out of its slump. McKesson had hit a 52-week low and boasted a P/E of 16 and a PEG of 1.46 at the time. McKesson appeared very attractive considering its EPS growth, dividend payout, acquisitive mindset and share buyback program. Now that the stock has nearly breached the $200 level thus appreciating over 34%, now what? Continue reading "McKesson Jumps 34% Off Lows - Now What?"