Over the past two years, it seems, Brazil has remained in the headlines for the very worst of reasons – corruption. In fact, the very latest scandal at Petrobras, the state owned petroleum giant, reached all the way to its upper echelon. Long gone are the days when the Brazilian government was praised for its fiscal discipline; the situation there has become so notorious that the name Brazil, it seems, has become synonymous with corruption. And as if this were not bad enough the country's main exports, which range from iron ore to agricultural goods, have tumbled in crisis. Yet, as investors, we always seem to intuitively look at the bright side of even the worst situation; in this case, we have thoughts of buying because when the situation is as bad as it is, we think, from here on out, that the situation can only get better. The Brazilian economy is basically at a standstill with a weak government at the helm, and there is one corruption scandal seemingly after another, and given the softness in commodities' prices the question that investors want an answer to is this: is the collapse in the Brazilian Real over?

A Broken Banking System

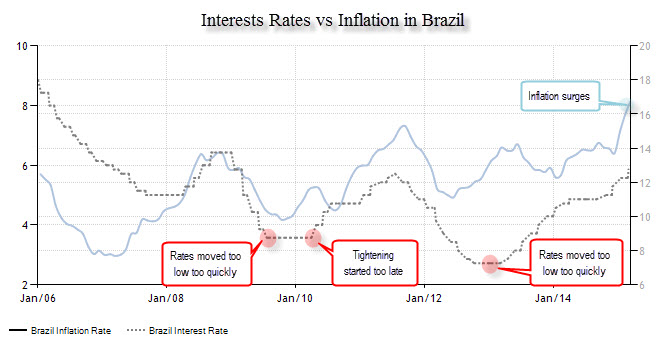

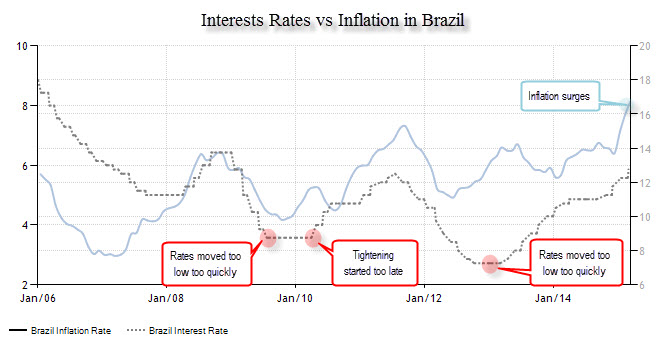

While many see corruption as the core problem in Brazil, this writer thinks the true core and the basis of the problem is, in fact, rooted in the country's banking system and at its heart, with Brazil's central bank, the Banco Central do Brasil. While reforms in the country are key for future growth it is the credibility of its central bank that is key for the Real, and as the chart below reveals, credibility is sorely lacking.

Chart courtesy of Tradingeconomics.com

The central bank has marked the 4.5% as the desired target for inflation. Yet the Brazilian central bank, generally amid political pressure to spur growth, has always eased policy prematurely and too aggressively. However, when it comes to tightening, the fact is the central bank doesn't apply those same standards. When in 2009 inflation peaked, rates were cut quickly, to as low as 8.75%, and left unchanged for several months. Soon after, though, inflation spiraled out of control once again, above 7%. And yet again, the Brazilian central bank was behind the curve, tightening too slowly and allowing inflation to move outside its targeted range. Once inflation slowed to 4.91% the central bank once again cut rates, this time even more aggressively than before, and the results were not pretty. As seen in the chart, inflation was soon out of control, to the extent that the latest reading on inflation hit 8.13%, once again spurred on by a central bank that hands out rate cuts much too easily. Continue reading "The Brazilian Real: From Bad To Ugly" →