Market Swoon

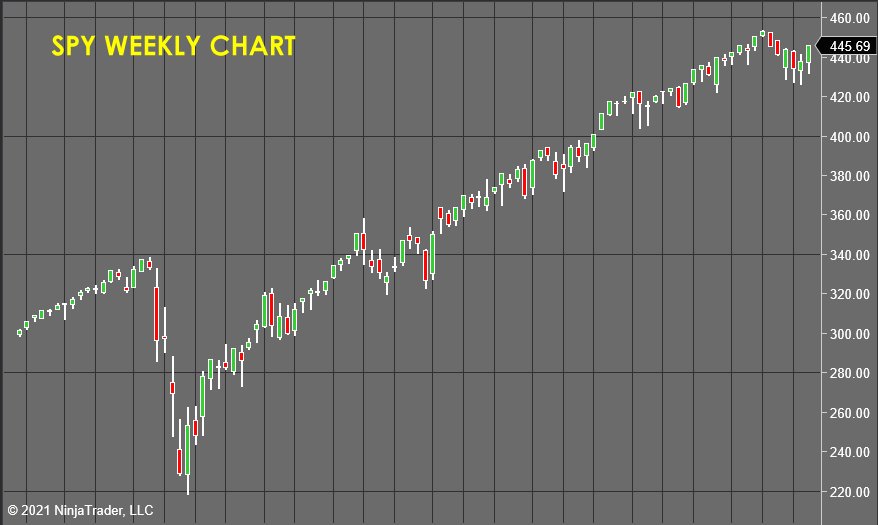

Inflation, interest rates, employment, Fed taper, pandemic backdrop, Washington wrangling, supply chain disruptions, slowing growth, and the seasonally weak period for stocks are all aggregating and resulting in the current market swoon. The month of September saw a 4.8% market drawdown, breaking a seven-month winning streak. The initial portion of October was met with heavy losses as well. Many individual stocks have reached correction territory, technically a 10% drop, while the Nasdaq is also closing in on that 10% correction level. Many high-quality names are selling at deep discounts of 10%-30% off their 52-week highs. The outlook for equities remains positive after the weak September as the economy continues to move past the pandemic. During these correction/near correction periods in the market, putting cash to work in high-quality long equity is a great way to capitalize on the market weakness for long-term investors. Absent of any systemic risk, there’s a lot of appealing entry points for many large-cap names. Don’t’ be too bearish or remiss and ignore this potential buying opportunity.

Deploying Capital

For any portfolio structure, having cash on hand is essential. This cash position provides investors with flexibility and agility when faced with market corrections. Cash enables investors to be opportunistic and capitalize on stocks that have sold off and become de-risked. Initiating new positions or dollar-cost averaging in these weak periods are great long-term drivers of portfolio appreciation. Many household names such as Starbucks (SBUX), UnitedHealth (UNH), Apple (AAPL), Amazon (AMZN), Micron (MU), Adobe (ADBE), Qualcomm (QCOM), 3M (MMM), Facebook (FB), Johnson and Johnson (JNJ), Mastercard (MA), Nike (NKE), PayPal (PYPL) and FedEx (FDX) are off 10%-30% from their 52-week highs. Even the broad market indices such as Dow Jones (DIA), S&P 500 (SPY), Nasdaq (QQQ), and the Russell 2000 (IWM) are significantly off their 52-week highs. All of these are examples of potentially buying opportunities via deploying some of the cash on hand. Continue reading "Market Swoon - Deploying Capital" →