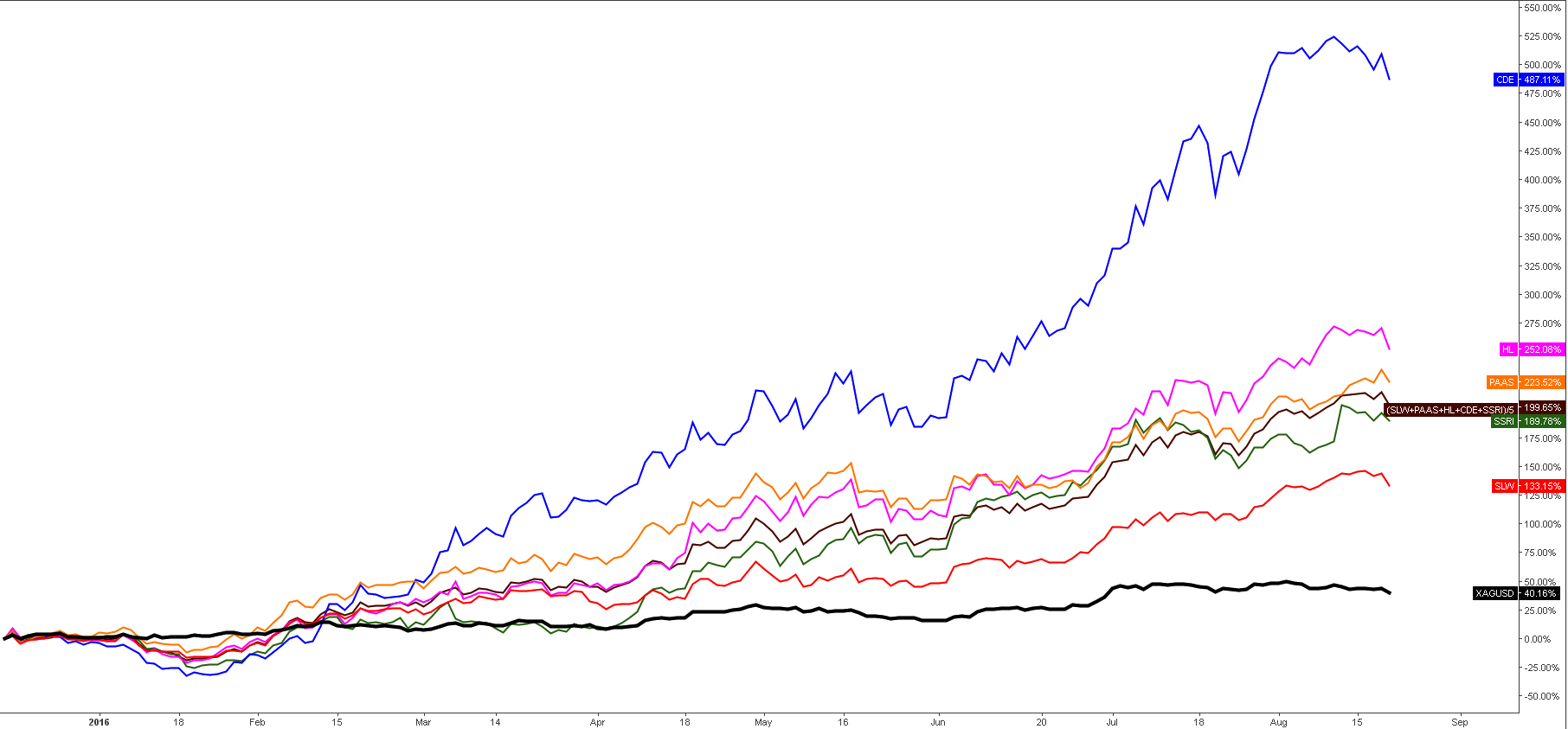

Sometimes we find a revelation in different things or places. Extending the range of our focus is quite helpful. From time to time I watch stock charts to find some interesting setups and to let my eyesight get a refreshing break from commodities and forex.

Last night I was browsing through some stock charts and my eyes caught a familiar structure on one of them. It was a chart of the iPath Bloomberg Coffee Subindex Total Return ETN (NYSE:JO). This instrument has a very interesting structure of complex correction on the chart. And today I would like to share with you an educational chart with a sample of a complex correction, which could take place in gold. It is better so see it once than to hear about it many times. Continue reading "Let's Read The Coffee Grounds To Understand Gold"