I wrote on February 24th about whether the time had come to take profits on oil refining stocks like Tesoro, Valero, and others. (My conclusion was to hold the stocks for the time being, but to keep a close eye on them).

Since then, oil refiners have continued rising (generally), as oil prices have showed continuing weakness – especially in the last 30 days. Crude oil, of course, is the key input for refiners, so refiners benefit when its raw materials prices are low. Nymex crude fell below $50/bbl Wednesday, having fallen from $61 on June 23, 2015, and from $107 on June 20, 2014 (data from eia.gov).

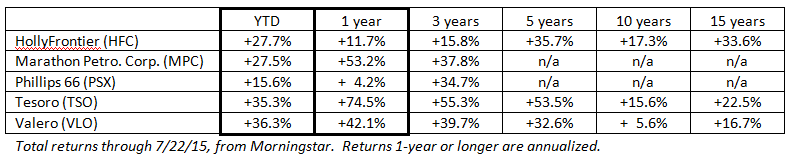

Here's an updated table showing performance of selected refiners through July 22:

On Thursday, July 23rd, oil and refining stocks both fell. But more often recently, it's been… Continue reading "Is It Time to Take Profits on Oil Refining Stocks? (re-visited)"