The non-farm payrolls report released last Friday dropped a bombshell on the market, revealing the US economy added 517K jobs in January 2023, surpassing expectations of 185K and the highest since July 2022.

Growth was seen in leisure and hospitality, professional and business services, health care, government, retail trade, construction, transportation and warehousing, and manufacturing. Despite tech layoffs and potential economic slowdown, the labor market remains tight, with November and December job numbers revised higher.

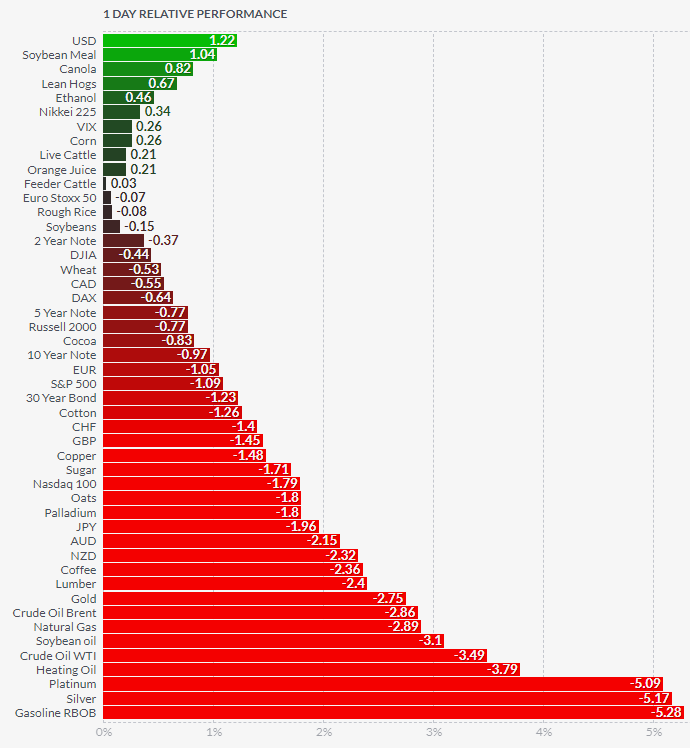

This was a real shocker that caused huge, unexpected waves of volatility in the markets. Let’s have a look at 1-day futures performance last Friday in the diagram below. It looks like a red sea with a small island covered in green grass.

Gasoline, silver and platinum were the ultimate losers that day with massive losses of -5.3%, -5.2% and -5.1% respectively. Gold futures lost huge -2.8% as well. Palladium futures price plummeted -1.8%. Among metals, Copper futures were the most resilient at -1.5%. Continue reading "Jobs Report Dropped A Bombshell On The Markets"