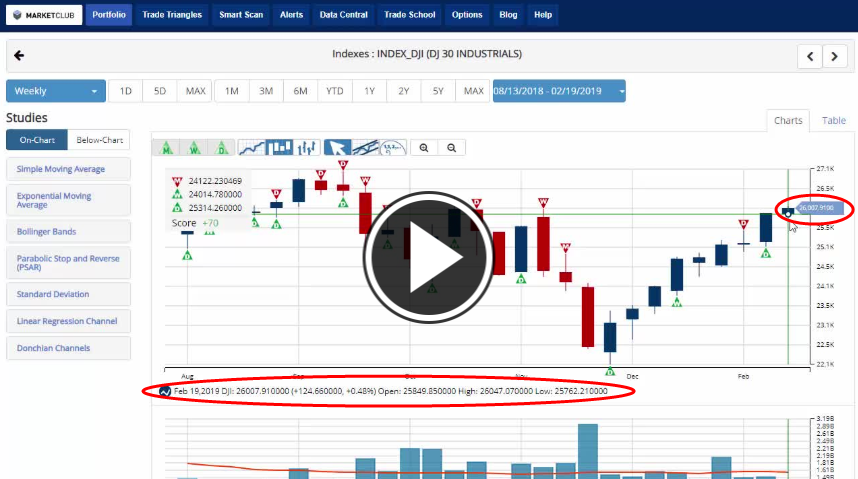

Hello traders everywhere. The week had started on high note extending last weeks gains and pushing the NASDAQ high enough to trigger a new green monthly Trade Triangle at 7,566.93. In fact, both the DOW and S&P 500 were close to getting their respective monthly Trade Triangles in early trading before they started to slide lower in Monday afternoon trading.

Stocks fell Wednesday as traders grappled with key testimonies on U.S.-China trade relations, Federal Reserve monetary policy and a host of geopolitical issues.

Stocks fell to their lows of the session as U.S. Trade Representative Robert Lighthizer hinted that a trade deal was not yet certain, saying that any agreement would need to be more than just purchases by China. The deal would need to be specific and include a matter of enforcement, he said. Lighthizer also noted that it would be a "long process" to implement any deal agreed upon in March. Lighthizer was testifying in front of the House Ways and Means committee. Trade relations between the U.S. and China lowered this week after President Donald Trump pushed back a deadline on adding additional tariffs on Chinese goods. Continue reading "China, North Korea And The Fed Weigh On Market"