The Gold Miner correction was well earned, but it was not a bubble.

Even today there is some pablum out there talking about how if inflation is good for gold it is especially good for gold miners. I will simply repeat once again that if gold usually does not benefit fundamentally by cyclical inflation (i.e. inflation promoted for and currently working toward economic goals) the gold miners never do, unless they rise against their preferred fundamentals as they did during two separate phases in the last bull market, which were justly resolved with crashes.

Here are a couple charts we used in NFTRH 648 in a segment written to set the record straight. We have also used these charts – especially the first one – since the caution flags went up last summer, visually by the first chart and anecdotally by the usual suspects aggressively pumping the unwitting masses. Buffett buys a gold stock!… okay, well so much for that. Sentiment became off the charts over-bullish and now, as we prepare for the final act of the correction, it’s the opposite. That’s perfect.

HUI had far exceeded the Gold/SPX ratio and so it was very vulnerable from a macro fundamental perspective. Why on earth would players want to focus on miners digging a rock out of the ground that was starting to fail in a price ratio to the stock market? They wouldn’t, and since last summer they didn’t.

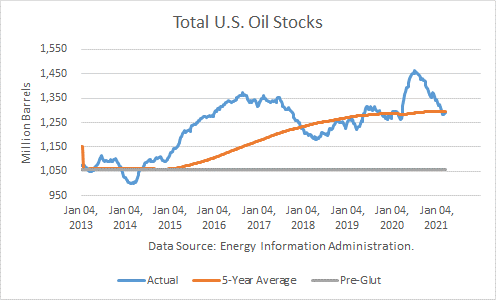

But from a sector fundamental perspective the Gold/Oil ratio (Oil/Energy is a primary driver of mining costs) and HUI show that the 2020 rally was nothing like the two bubbles of yesteryear, when not only did HUI hit danger signals (!) noted above by a macro fundamental indicator, it also made two separate bubbles vs. this sector fundamental. This time? Nope, no bubble here. Continue reading "Gold: What A Long And Not So Strange Trip"