Gold Futures

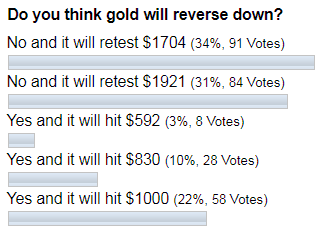

Gold futures in the June contract settled last Friday in New York at 1,698 while currently trading at 1,740 up over $40 for the week continuing it's bullish momentum while still experiencing high volatility.

At the current time, I do not have any precious metal recommendations as I was stopped out of silver earlier in the week. However, if you are long a futures contract, I would place the stop loss under the April 21st low of 1,666 as an exit strategy as this is a very high-risk trade with large price swings that we experience daily. For the bullish momentum to continue, prices have to break the April 14th high of 1,788 in my opinion as we are witnessing a bullish trend as we are above the 20 and 100-day moving average. However, the problem with this market at the current time is that it has large sell-offs and then comes back every single time, but it has not been an easy trade to the upside even though we are trading at a 7-year high.

Economic stimulus continues to support prices as the U.S. government is putting trillions of dollars into the economy because of the Coronavirus situation as that is supportive towards the precious metals as trading this commodity should only be dealt with large trading accounts due to the risk.

TREND: HIGHER

CHART STRUCTURE: POOR

VOLATILITY: HIGH

Coffee Futures

Coffee futures in the July contract settled last Friday in New York at 117.55 while currently trading at 109.60 a pound down about 800 points for the trading week hitting a 5-week low as prices look to head back down to the 100 level in my opinion. Continue reading "Gold Futures Trade At Seven Year High"